Ontario Employer Health Tax (EHT)

In 1990, the Ontario Employer Health Tax act was created. The act imposes a payroll tax that provides partial funding by Ontario employers for the Ontario Health Insurance Plan.

The following are items you need to consider regarding exemption or not:

- You do not have to pay any EHT if your annual payroll does not exceed $450,000.

- EHT also does not apply to any self-employed individuals.

- Only one annual exemption of $450,000 is available for an associated group of employers. Any associated employers at any time during the year must take into account the total Ontario remuneration of each associated entity to determine if the exemption can be claimed.

- If the combined total Ontario remuneration of all the associated employers exceeds $5 million, these employers are not eligible for the EHT exemption.

The purpose of this document is to provide you with the basis needed for EHT Earnings tracking and premium calculation when earnings exceed $450,000 by division.

Configuring Divisions

You need to configure EHT divisions for the purpose of accumulating and reporting EHT costs by division to populate the list as Work Types.

To populate the division list as Work Types:

- Open the Work Types page. In the Search field, type Work Types and then select the page from the drop-down list.

The Work Types page displays. - Enter values in Code and Description.

Specifying Dimensions for Work Type Mapping

You need to specify which dimension will hold the reference to the Work Type. Dimensions are used on all transactions and a respective dimension value will be linked to a division.

To specify the dimension that tracks the site or location dimension the values of which will be mapped to the Work Type:

- Open the Payroll Setup page. In the Search field, type Payroll Setup and then select the page from the drop-down list.

The Payroll Setup page displays. - Expand the General FastTab.

- Select a value in Dimension for Work Type.

- Click OK.

Linking Dimension Values to Work Types

You need to link one or multiple dimensions to a Work Type to enable payroll calculation based on the EHT division by default.

To link the dimension values on the dimension specified in the payroll setup:

- Open the Dimensions page. In the Search field, type Dimensions and then select the page from the drop-down list.

The Dimensions page displays. - In the Ribbon, click the Navigate tab and then click Dimension Values.

The Dimension Values page displays. - Select a Work Type Code (EHT division) to be linked to the respective dimension values.

- Click OK when finished.

Configuring Payroll Controls

You need to configure two sets of Payroll Controls needed to calculate the Employer Health Tax.

- EHT-EARN-DIV-X to track the EHT applicable earnings by EHT Division (Work Type).

- EHT-DIV-X to calculate the EHT liable amount once the earnings for each EHT Divsion go over the EHT threshold. The threshold is created as a Bracket Code that is then part of the method steps for the payroll control calculation.

Note: X is to specify the division as you might have more than one.

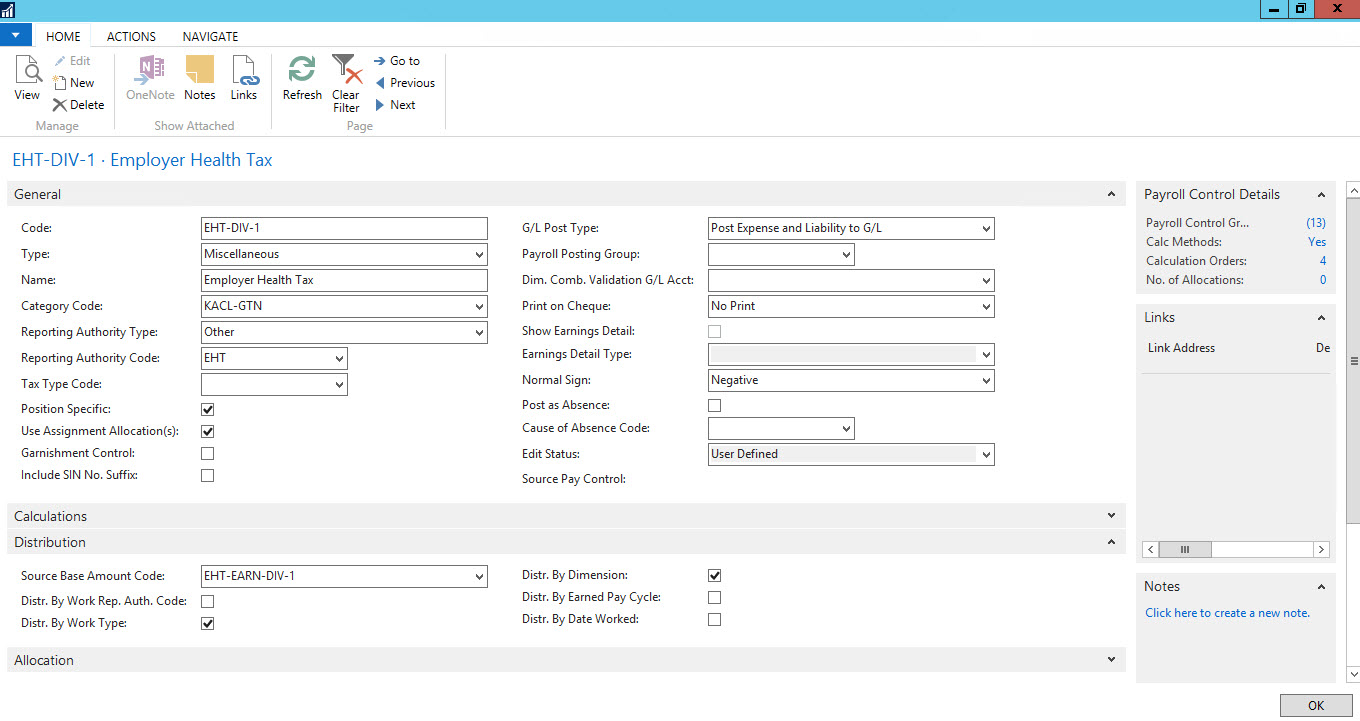

The EHT payroll controls for both EHT-EARN-DIV and EHT-DIV need to be configured in a certain way for the configuration to work:

- Add a checkmark to Position Specific.

- Add a checkmark to Use Assignment Allocation.

- In the Distribution fast tab the Source Base Amount Code field select the EHT Earnings by Division payroll control EHT-EARN-DIV-X.

- Add a checkmark to Distr. By Work Type should be checked.

- Add a checkmark to Distr. By Dimesion should be checked.

An example of EHT-DIV-X payroll control configuration is shown below.

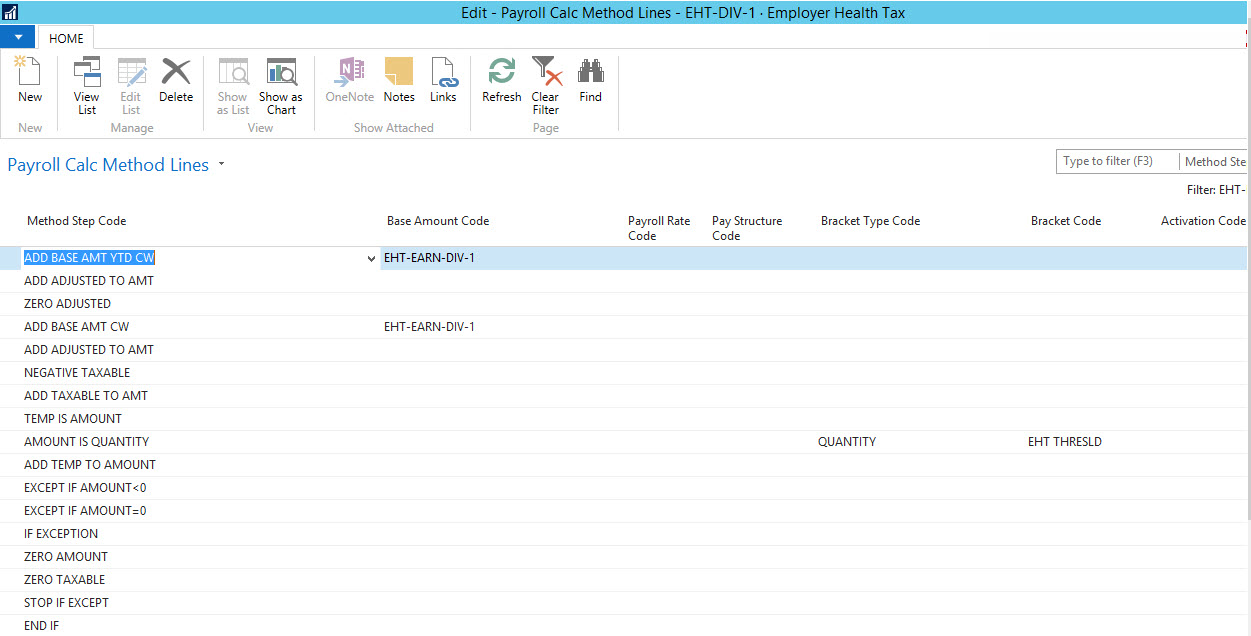

Two new method steps have been created to support the EHT calculations:

| Method step code | Details |

| ADD BASE AMT YTD CW | This method step, uses Function 2007 to add the base amount Year to Date company wide and looks at payroll ledger entries and aggregates the EHT Earnings by Work Type. |

| ADD BASE AMT CW | This method step, uses Function 2701 to adds the base amount company wide and looks at the payroll journal lines and aggregates the EHT Earnings by Work Type in order to use it to compare against the EHT Threshold. The threshold is per division (Work Type). |

Note: With the two amounts added together, the system can now compare against the threshold and establish the need to calculate the premium or skip.

Payroll Calculation

The Work Type, based on the dimension values coming with the payroll entries, will be populated once the payroll entries have been preloaded into the Payroll Journal. The payroll calculation process will generate the entries for the EHT Earnings and properly distribute the amounts into the corresponding Work Type Code based on the Dimension mapping.

Once an EHT division earnings exceed the threshold amount, the calculation will generate your entries for the actual employer EHT liability amounts.