The OECTA (Ontario English Catholic Teachers Association) membership fee is automatically calculated for every registered teacher and a report is generated for the 3rd party on a monthly basis. This section describes the configuration and procedures relevant to the OECTA Membership Fee functionality.

Setup Steps

- In the Search field, type Altus HR Setup and select the page from the drop-down list.

The Altus HR Setup page displays. - Expand the Advanced Position Management FastTab.

- Add a checkmark to the Enable Advanced Position Mgt. check box.

- In the Search field, type Payroll Controls and select the page from the drop-down list.

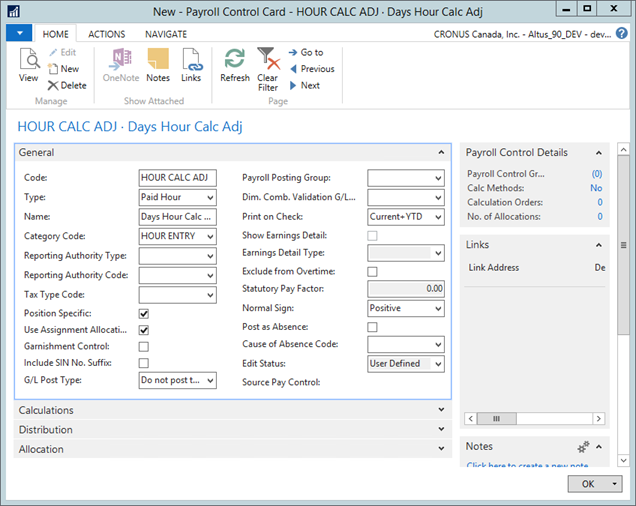

The Payroll Control page displays. - Open the payroll control that is used for calculating adjustments. This payroll control is used in configuring Ontario Teachers' Pension Plan.

- Add a checkmark to the Position Specific and Use Assignment Allocation check boxes.

- In the Dimensions page, make sure that you have a dimension that is used to distinguish between Elementary and Secondary schools.

- In the Search field, type Assignment Reason Codes and select the page from the drop-down list.

- Add assignment reason codes for each member type as follows:

| Code | Description |

| CE | Continuing Education |

| FT | Full Time |

| LT | Long Term Occassional |

| OM | Occasssional |

| PT | Part Time |

- In the Search field, type Inactivity Status Codes and select the page from the drop-down list.

- Add the following list of inactivity codes:

| Code | Description |

| DS | Deferred Salary |

| PL | Paid Leave |

| UL | Unpaid Leave |

- In the Search field, type Causes of Inactivity and select the page from the drop-down list.

- Assign the inactivity status codes as follows:

- In the Search field, type HR Positions and select the page from the drop-down list.

- Create lists of HR Jobs and HR Positions. Link the positions to HR Jobs.

- In the Search field, type Pay Structures and select the page from the drop-down list.

- Make sure that the Yearly Salary Adjmt Factor in the Pay Structures table equals “1” to allow proper calculation of the Current Grid.

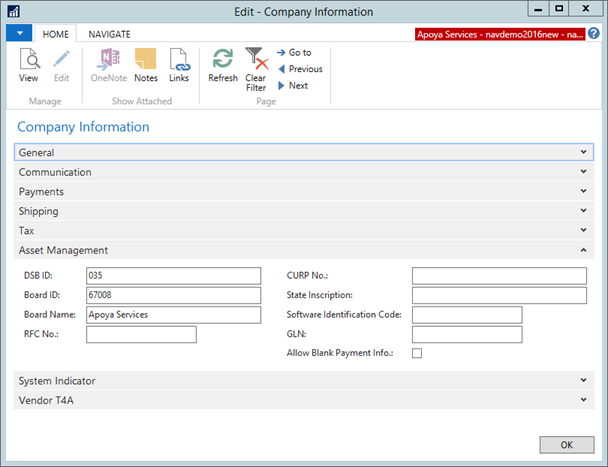

- In the Search field, type Company Information and select the page from the drop-down list.

The Company Information page displays. - Expand the Asset Management FastTab.

- In the Board ID field, enter your Ministry Board ID.

- In the Search filed, type Location and select the page from the drop-down list.

The Location page displays. - In the Alternative Location Code field, enter the Ministry School ID.

- In the Search field, type HR Employees and select the page from the drop-down list.

The HR Employees page displays. - For all applicable employees:

- Open their HR Employee Card.

- Expand the Administration FastTab.

- In the Prof. Association No. field, enter their professional association number.

- Click OK.

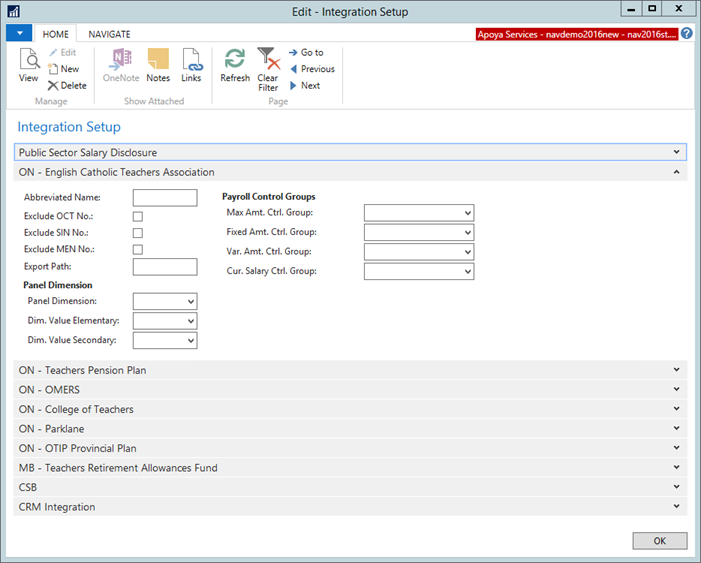

Configuring the Integration Setup

- In the Search field, type Integration Setup and select the page from the drop-down list.

The Integration Setup page displays. - Expand the ON – English Catholic Teachers Association FastTab.

- The following table explains the options available when setting up the fast tab of ON – English Catholic Teachers Association in Integration Setup. Use the details provided below for configuring:

| Field | Description |

|

Abbreviated Name |

To be used as part of the name of the file being generated. |

|

Exclude OCT No. |

Add a checkmark to this check box if you do not want the file to contain Prof. Association No. from the HR Employee page. |

|

Exclude SIN No. |

Add a checkmark to this check box if you do not want the file to contain Social Insurance No. from the HR Employee page. |

| Exclude MEN No. | Add a checkmark to this check box if you do not want the file to contain Ministry Identification No. from the HR Employee page. |

|

Export Path |

Enter a folder location on your network drive where the file generated by the system will be stored. |

|

Panel Dimension |

Select the dimension used to distinguish between Elementary and Secondary schools. |

| Panel Dimension Start Position | If certain characters within Panel Dimension designate the actual Panel value, enter the start position that indicates where the Panel value begins within the dimension indicated in the Panel Dimension field. |

| Panel Dimension Length | Indicate the length of the Panel value contained in the dimension indicated in the Panel Dimension field. This field is required if the Panel Dimension Start Position is non-zero. |

|

Dim. Value Elementary |

Select a dimension value for the Elementary Panel. |

|

Dim. Value Secondary |

Select the dimension value for the Secondary Panel. |

|

Fixed Amt. Ctrl. Group |

Select a payroll control group from the dropdown list for calculating the fixed amount of the OECTA deduction. |

|

Var. Amt. Ctrl. Group |

Select a payroll control group from the dropdown list for calculating the variable amount of the OECTA deduction. |

|

Cur. Salary Ctrl. Group |

Select a payroll control group from the dropdown list for calculating current salary. |

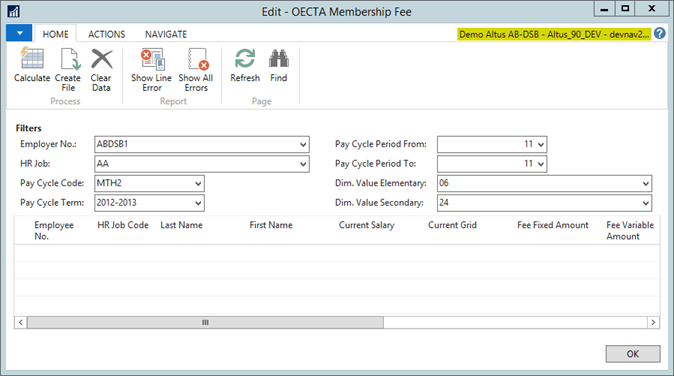

Configuring and Running the OECTA Membership Fee Report

A number of setup steps have to be completed before running the OECTA Membership Fee report.

- In the Search field, type OECTA Membership Fee and select the page from the drop-down list.

The OECTA Membership Fee page displays.

- In the Filters section, select the applicable filter options.

- From the Ribbon, click Calculate to populate the worksheet with data based in the filters selected.

- The system will automatically run a validation to check for errors. If a line has errors, the Validated checkbox will not be checked and the Errors column will show the number of errors. To check the errors:

- From the Ribbon, click Show Line Error to see the errors on an individual line,

- From the Ribbon, click Show All Errors to see a list of all errors.

- Modify the data to eliminate the errors and run Calculate again.

Note: You can use the Navigate tab to quickly open the related Employee Card and Assignments. - From the Ribbon, click Create File.

A file is generated and sent to the 3rd party. The file is stored in the location specified in the Integration Setup page, Export Path field. - If you need to create a report, use the standard NAV functionality for exporting to Excel.

NOTE: The report should be created in separate lines for each unique combination of Employer, HR Job Code, Pay Period, Employee, Assignment Type, Panel Dimensions (defined in the Integrations Setup: OECTA Panel Dimension), Cause of Inactivity and/or Termination Date.

Data Format

The following table shows the fields and provides descriptions for the information included in the 3rd party file generated by the system.

| Field | Data Format | Details |

|

Last Name |

30A |

Populated from the HR Employee. |

|

First Name |

30A |

Populated from the HR Employee, Personal tab. |

|

Address |

30A |

Populated from the HR Employee, Communication tab. |

|

Address 2 |

30A |

Populated from the HR Employee, Communication tab. |

|

City |

30A |

Populated from the HR Employee, Communication tab. |

|

State |

2A |

Populated from the HR Employee, Communication tab. |

|

Zip Code |

A9A9A9 |

Populated from the HR Employee, Communication tab. |

|

Social Insurance No. |

999999999 |

Populated from the HR Employee, Payroll tab. NOTE: The field will be blank if the Exclude SIN No. field has not been checked in the Integration Setup for OECTA. |

|

Ministry Identification No. |

999999999 |

Populated from the HR Employee, Administration tab. NOTE: The field will be blank if the Exclude MEN No. field has not be checked in the Integration Setup for OECTA. |

|

Alternative Location Code |

999999 |

Populated with the Ministry School ID configured in the Location Table. the Location Code to be used for this value can be selected as follows:

|

|

Board ID |

999999 |

Populated with the Ministry Board ID from the Company Information page. |

|

ActSal |

999999.99 |

Annual Actual Salary This field should be left blank. |

|

GridSal |

999999.99 |

Annual Grid Salary This field should be left blank. |

|

FeeFixAmt |

9999.99 |

Populated with the sum of the Amount column from the Payroll Ledger Entries table using the Payroll Controls found in the Fixed Amount payroll group specified in the Integration Setup for OECTA. |

|

FeeVarAmt |

9999.99 |

Populated with the sum of the Amount column from the Payroll Ledger Entries table using the Payroll Controls found in the Variable Amount payroll group selected in Integration Setup OECTA. |

|

FTE |

999.99 |

Populated with the sum of the FTE from HR Position Ledger Entry. NOTE: If an employee has one position, it will show the FTE as it is. If one employee holds two positions within the same panel dimension and assignment type, the values of the FTEs will be totaled. If either the panel or the assignment type is different, the report will create separate lines and the FTE value will be the total by Panel and Assignment type. |

|

PayEndDate |

mm/dd/yyyy |

Populated with the Pay Period End Date from the Payroll Ledger Entry. |

|

PayPeriod |

99 |

Populated with the Pay Cycle Period from the Payroll Ledger Entry. (Pay Period 01, 02, etc) |

|

MemType |

AA |

Populated with the Assignment Type from the Assignment Reason Type page. The predefined list of Assignment Types should include the values below:

|

|

MemStatus |

AA |

Populates AC when the Cause of Inactivity for the HR PLE is blank or Termination Date is blank or after the Pay End Date. Populates TE when the Termination Date on the HR PLE falls between the start and end dates of the pay cycle period selected in the options tab. If the Cause of Inactivity on the HR PLE is not blank, display the code from the Cause of Inactivity table. |

|

MemPanel |

A |

Populates E if the value in the Dim. Value Elementary field in the Integration Setup matches the dimension value on the Payroll Ledger Entry. Populates S if the value in the Dim. Value Secondary field in the Integration Setup matches the dimension value on the Payroll Ledger Entry, otherwise the field will be blank. |

|

CurrSal |

999999.99 |

Displays the sum of the Amount column from the Payroll Ledger Entries table for Payroll Controls from the Cur. Salary Ctrl. Group, specified in the OECTA Integration Setup |

|

CurrGrid |

999999.99 |

If the Yearly Salary Adjmt Factor (coming from the Pay Structure assigned to the HR PLE) = 1 the current grid amount will be calculated as follows:

If Yealy Salary Adjmt Factor (coming from the Pay Structure assigned to the HR PLE) <> 1 the current grid amount will be calculated as follows

|

|

OCT |

Displays the Prof. Association No., from the HR Employee. NOTE: If the Exclude OCT No. field is checked on the Integration Setup for OECTA page, this column will be blank. |