Bank accounts must be reconciled regularly. The bank reconciliation feature is used to check the bank ledger entries and the balance on the accounts against the statement from the bank.

This section explains the Bank Account Reconciliation page and then describes the process of populating the bank reconciliation lines to prepare for the bank reconciliation.

Bank Account Reconciliation Page Overview

To access the Bank Account Reconciliation page:

- Open Microsoft Dynamics NAV 2016.

- In the Search field, type Bank Account Reconciliation and select the page from the drop-down list.

The Bank Account Reconciliations page displays. - Double-click an entry to display the Bank Rec. Worksheet.

The Bank Rec. Worksheet enables users to perform all of the necessary processes from one page to reconcile the bank account ledger entries to the bank statement. The process includes evaluating differences between the Bank Account in NAV and the bank statement from the bank. Differences can be linked to outstanding checks and deposits and transactions reported on the bank statement that have not been posted to the bank account ledger (that is, interest, NSF). In addition, there could be erroneous ledger entries or transactions recorded either by the company or the bank.

The tasks involved in reconciling a bank account include:

- marking all bank ledger entries for the bank account that agree with the transactions on the bank statement.

- posting transactions recorded by the bank only.

- correcting errors on your bank account.

- registering possible bank errors.

- posting the bank reconciliation for future reference.

The Bank Rec. Worksheet includes five FastTabs that allow all of these functions to be performed from one screen. On the Checks and Deposits/Transfers FastTabs, notice that the lines are blank. Use the Actions > Functions > Suggest Lines to select the ledger entries that will populate these lines. This process is described later in this section.

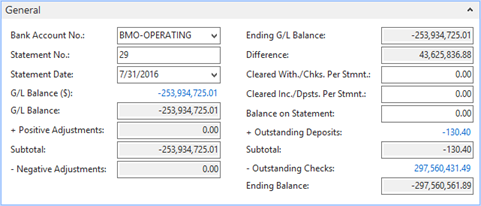

General FastTab

The General FastTab provides the means to create a new bank reconciliation statement. It provides information that allows the user to reference back to the General Ledger account balances. The General FastTab summarizes necessary information for matching balances from the bank statement to balances in the General Ledger and Bank Account Ledger. If all the suggested reconciliation lines match the bank statement exactly, then the bank reconciliation can be posted for that period. However, there are normally some differences that must be handled accordingly.

The fields on the General FastTab are as follows:

| Field | Description |

| Bank Account Number | Bank account number. This field is used to select the bank account to be reconciled. |

| Statement No. | Bank statement number. This field is auto-filled based on information on the Bank Account Card. |

| Statement Date | Specify the last date covered by the statement from the bank. |

| G/L Balance ($) | System-calculated field which reflects the balance for the G/L Account assigned to the bank account, or the local currency in the General Ledger. |

| G/L Balance | This is a system calculated field which reflects the balance for the G/L Account assigned to the bank account as of the statement date in the currency associated with the bank account at the exchange rate as of the statement date. |

| Positive Adj. | This field reflects the positive adjustments found on Adjustment FastTab. |

| Subtotal | The total balance in the Bank as of the posting date + any additional positive adjustments. |

| Neg. Adj. | This field reflects the negative adjustments found on the Adjustment FastTab. |

| Ending G/L Balance | The summation of the subtotal field and the negative adjustment field. This field reflects the balance in the G/L Account after the posting of the bank reconciliation in the currency associated with the bank account at the exchange rate applicable as of the statement date. |

| Difference | Difference between the ending G/L balance and the ending balance for the bank statement. This difference must be zero for the bank reconciliation to post. |

| Cleared With/Chks. Per Stmnt. | These fields allow entering of the total of those items that cleared the bank, which are normally totals printed on the statement. These are optional fields but these fields serve as a point of reference on the checks and Deposits/Transfers FastTab when clearing these transactions. |

| Cleared Inc./Dpsts. Per Stmnt. | Total deposits that have cleared the bank. |

| Balance on Statement | Used to enter the bank statement balance. |

| Outstanding Deposits | Reflects the open deposit entries that have not cleared. |

| Subtotal | The total of the statement balance plus any outstanding deposits. |

| Outstanding checks | Reflects those open checks/withdrawal entries that have not cleared. |

| Ending Balance | Calculation of Balance on statement + outstanding deposits – outstanding checks. |

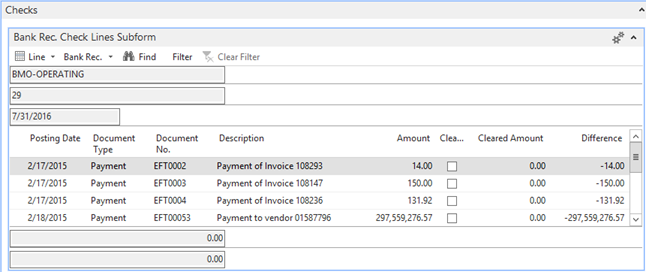

Checks FastTab

Displays all the outstanding checks written on or prior to the statement date.

In the lines, the Cleared field indicates the checks that have posted to the bank account and appear on the bank statement. When the Cleared field is populated, the Cleared Amount field is automatically populated. This process can be manually performed in the lines or through the use of the Function button, by pressing Mark Lines.

When a check clears for more or less than the recorded amount in the Bank Account Check Ledger Entries, the Cleared Amount field can be edited to record the actual amount of the check cleared by the bank on the bank statement.

When the checks are not cleared for the amount specified in the Amount column, a difference will result based upon the balance in the Amount field and the Cleared Amount field.

These differences will have to be recorded as adjustments in order to allow the bank reconciliation to be posted.

To have the system generate the adjusting entry, use the Record Adjustments function, or the entry can be entered manually. The Record Adjustment process populates the Adjustment FastTab with the entries required to create a journal entry in the system.

The fields on the Checks FastTab are as follows:

| Field | Description |

| Posting Date | The date when the check was posted. |

| Document Type | The document type. |

| Document No. | The document number. |

| Description | The check description. |

| Amount | The actual amount of the check cleared by the bank on the bank statement. |

| Cleared | Specifies if the check has been cleared by the bank. |

| Cleared Amount | The amount of the check balance that has been cleared by the bank. |

| Difference | The outstanding check balance waiting to be cleared. This field displays the difference between the Amount and Cleared fields. |

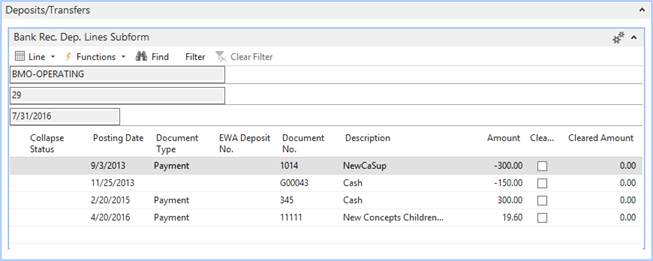

Deposits/Transfers FastTab

The Deposits/Transfers FastTab displays all of the outstanding positive entries made on or prior to the statement date. This FastTab also displays all negative and positive transfer entries. The Cleared field is selected to specify which deposits and Transfers have posted to the bank account.

When there are discrepancies between the amount on the bank statement and the Bank Ledger Entry, the differences can be recorded in the cleared amount field.

The Record Adjustments function, can be selected to record an adjustment to be posted. The Statement field at the bottom of the form reflects the amount entered in the cleared deposit field on the general FastTab. The Total Cleared field represents the total of the lines marked as cleared.

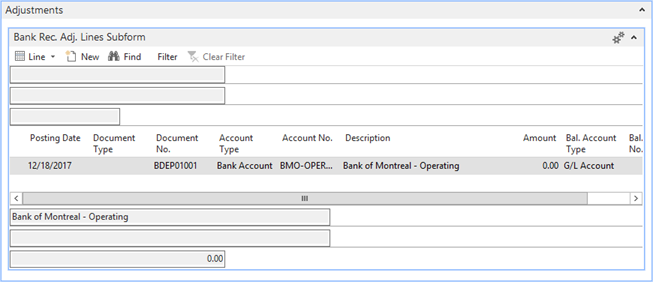

Adjustments FastTab

The Adjustments FastTab displays all the entries created from the differences on the checks and the Deposit/Transfers FastTab. This page could also be used to record charges or deposits made by the bank but not recorded in the bank account ledger, such as pre-authorized payments and service charges. The bank may also deduct fees like safety deposit box rentals or NSF charges. Those adjustments would also be recorded here as an adjustment for posting to the General Ledger.

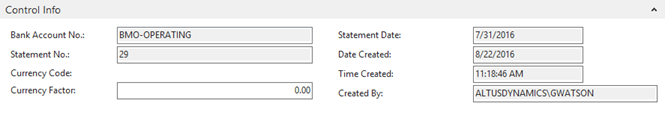

Control Info FastTab

The Control Info FastTab is a summary of information related to the current Bank Rec. Worksheet. The information includes default information from the General FastTab, fields for the currency code associated with that bank and information related to creation of the bank reconciliation.

The fields on the Control Info FastTab are as follows:

| Field | Description |

| Bank Account No. | Specifies the bank account number. |

| Statement No. | The bank statement number. This field is auto-filled based on information on the Bank Account Card. |

| Currency Code | Unique three-digit identifier for the currency. |

| Currency Factor | This field is used for currency conversions when posting adjustments for bank accounts with a foreign currency code assigned. |

| Statement Date | Specifies the last date covered by the statement from the bank. |

| Date Created | The date when the bank reconciliation was created. |

| Time Created | The time when the bank reconciliation was created. |

| Created By | The user that created the bank reconciliation. |

Reconciling the Bank Statement

The bank statement received will reflect all the transactions that have taken place for the time period specified on the bank statement. Upon initial review, you should notice the difference in the ending balance in the company’s records and the ending balance on the bank statement. After reviewing the bank statement and scanning through the transactions, the first step to begin reconciling the bank statement is to create a Bank Rec. Worksheet for the period reflected in the statement.

This is done by going to Financial Management > Cash Management > Bank Account Reconciliations.

Creating the Reconciliation Worksheet

To create the Bank Reconciliation worksheet:

- Select the Bank Account number in the Bank Account No. field.

- The system will populate the Statement No. field based on the information on the Bank Account Card. If this is a first recon in the system, fill in the statement number.

- Enter the Statement Date of that is being reconciled.

- Based on the information in the bank statement, populate the Cleared checks Per Statement, the Cleared Deposits Per Statement, and the Balance on Statement. (optional).

- Pull all open bank ledger entries into the Bank Reconciliation Worksheet. To populate the reconciliation lines, click Ribbon Actions > Suggest Lines.

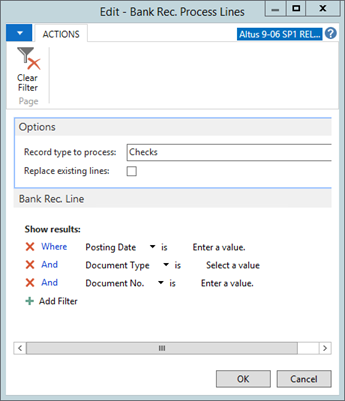

Suggest Lines Function

Using the Bank Rec. Process Lines page, you can filter on field information such as Posting Dates, Document Type, and Document No. to determine which open bank transactions populate on the worksheet. The Options FastTab of the request page allows additional filtering capabilities. Users also have the option to replace any existing lines in the worksheet with new lines based on any criteria set when the suggest process is ran again. These entries will reflect all open bank ledger entries with a posting date on or before the Statement Date specified on the General FastTab.

Click OK on the Suggest Lines page.

The General FastTab fields are updated based upon the transaction lines pulled by the Bank Rec. Suggest Lines function. The Outstanding Deposit field now reflects the total positive entries posted to the selected bank and entries are populated within the lines area of the Deposit/Transfer FastTab.

The Outstanding checks field also reflects the total negative entries posted to the bank. The amounts calculated down to arrive at an Ending Balance.

NOTE: these fields represent entries not marked as Cleared on the corresponding FastTabs.

Marking Cleared Lines

Compare the suggested lines with the transactions on the bank’s statement

To indicate that the check has been cleared through the bank, the Cleared field on the transaction line must be checked. This same process must be performed on the Deposits/Transfers FastTab for the deposits or positive transactions posted to the bank.

The Cleared field on the Deposit FastTab should also be checked for these transactions to indicate that they have cleared the bank.

If the bank statement has an erroneous transaction, it will not be able to apply it to a ledger entry. To handle this situation, change the amount in the cleared amount field to reflect the actual amount cleared by the bank. This will result in a difference amount for that particular transaction line.

Recording Adjustments

Errors in deposits require clicking the Cleared field and change the amount in the cleared amount field to the correct amount. There should be an amount in the difference field.

To record an adjustment to indicate the error that has been posted to the bank statement:

- Click Actions > Functions > Record Adjustments.

- Select the Record Type to Process and press the OK button on the request form.

This will create an adjusting journal entry to record the erroneous entry. The entry will post to the Bank Ledger Entry and General Ledger Entries tables.

After the function is run, the positive adjustment is recorded on the General FastTab.

Errors in the check amount require the same procedure as errors in deposits.

To record an adjustment in check amounts, an entry must be recorded on the Adjustment FastTab to adjust the bank’s balance.

Once the adjustment is entered on the Adjustment FastTab, there is no longer a difference indicated in the difference field. Once the Bank Rec. Worksheet is posted, the journal entries will be recorded.