Review this section to learn about the Bank Account Page, the Bank Account Card, the Bank Account Card Action Pane, and how to Create a Bank Account in NAV.

Overview

For each transaction made in NAV using a bank account, the system will post an entry in the bank account ledger.

The bank account posting group assigned to each bank account enables the program to post the related G/L entries with the transaction.

In addition, if the user makes a manual or computer check payment, the system posts an entry to the check ledger to record the check transaction and the current status of the check.

Each bank account has its own card that contains information, such as the following:

- Name, address, and contact information

- Account numbers

- Posting specifications

- International banking

- Wire transfers

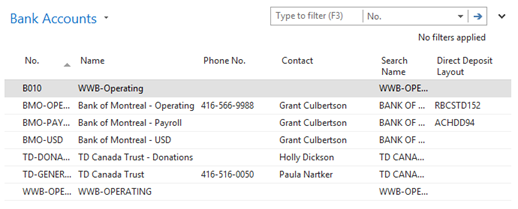

Bank Account Page

To access the Bank Account page:

- In the Search field, type Bank Accounts and select the page from the drop-down list.

The Bank Accounts page displays.

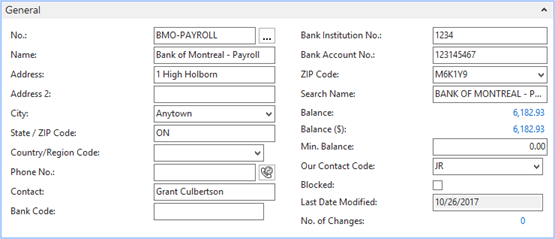

Bank Account Card

Double-click on a bank account to see the Bank Account Card.

General FastTab

The General FastTab contains all the general information about the bank where the account is held such as the:

- Name

- Address

- Main contact person at the bank

- Search name

In addition to this information, the General FastTab includes the following fields:

| Field | Description |

| No. | A unique identifier to represent the bank account. This field is not used to specify the bank account number. |

| Name | The bank name. |

| Address / Address 2 | The bank address. |

| City | The city in which the bank is located. |

| State/Province | The state or province in which the bank is located. |

| Country/Region Code | The country in which the bank is located. |

| Phone No. | The bank phone number. |

| Contact | The name used when searching the Bank Account Cards. |

| Bank Code | The alphanumeric code used to represent the bank branch number for the bank account. All banks have a number series that specifies the branch of the bank the account was opened. |

| Bank Account No. | The bank account number that is used by the bank. |

| Zip Code | The bank zip code. |

| Search Name | The name used when searching Bank Account cards. |

| Balance and Balance (LCY) | These fields are flow fields that calculate the current bank balance based on the bank ledger entries. |

| Min. Balance | The minimum balance the bank account can have. The amount is in the currency of the bank account and can be positive or negative. |

| Our Contact Code | The contact person in the user's company responsible for the bank account. In the program, this must be someone set up in the Salespeople/Purchasers page. |

| Blocked | If selected, prevents the bank account from being used in transactions. |

| Last Date Modified | The date when the Bank Account Card was last modified. |

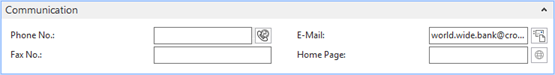

Communication FastTab

The Communication FastTab contains the following fields:

| Field | Description |

| Phone No. | The bank phone number. |

| Fax No. | The bank fax number. |

| The bank email address. | |

| Home Page | The bank home page. |

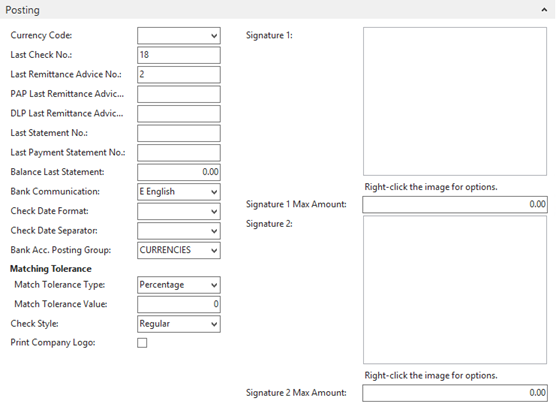

Posting FastTab

The Posting Fast Tab contains the following fields:

| Field | Description |

| Currency Code | The currency for the bank account. Be aware that checks can only be made for payments in the currency of the bank account. If the Currency Code field of a bank account is blank, check payments can be made only in in local currency (LCY) for that account. If a currency code is selected in this field, only use this bank account to receive and make payments in the currency selected in this field. If a currency code is not selected, you can receive payments by using any currency including LCY. Non-check payments can use any currency including LCY. You can only make check payments in LCY. |

| Last Check No. | If using checks, specify the last check number that is used. The program updates this number every time that a new check is created. |

| Last Remittance Advice No. | Number of the last remittance advice sent. |

| PAP Last Remittance Advice No. | The starting point for the serial number used as the Pre-authorized Payment Remittance Advice document number. This field is used to setup PAP Remittance Advice number sequence and will be used to populate the bank ledger and check ledger entries. |

| DLP Last Remittance Advice No. | The starting point for the serial number used as the Deferred Leave Plan Remittance Advice document number. (This field is used to setup DLP Remittance Advice number sequence and will be used to populate the bank ledger and check ledger entries.) |

| Last Statement No. | The statement number of the last bank account statement reconciled in the program. |

| Balance Last Statement | The statement ending balance of the last bank account statement reconciled in the program. |

| Bank Communication | Language used for bank communications. |

| Check Date Format | The date format used for checks. |

| Check Date Separator | The character used to separate Month, Day and Year of the date that prints on the check image. |

| Bank Acc. Posting Group | The posting group assigned to this bank account. Microsoft Dynamics NAV 2016 uses this to post the related G/L entries for each transaction by using the bank account. |

| Match Tolerance Type | Specifies the tolerance that the automatic payment application function uses to apply the Amount Incl. Tolerance Matched rule. |

| Match Tolerance Value | Specifies if the automatic payment application function will apply the Amount Incl. Tolerance Matched rule for this bank account. |

| Check Style | The style of check used. |

| Print Company Logo | Enable this checkbox to include the company logo when printing. |

| Signature 1 | Signature of the first signing authority. |

| Signature 1 Max Amount | The maximum dollar amount for the first signing authority. |

| Signature 2 | Signature of the second signing authority. |

| Signature 2 Max Amount | The maximum dollar amount for the second signing authority. |

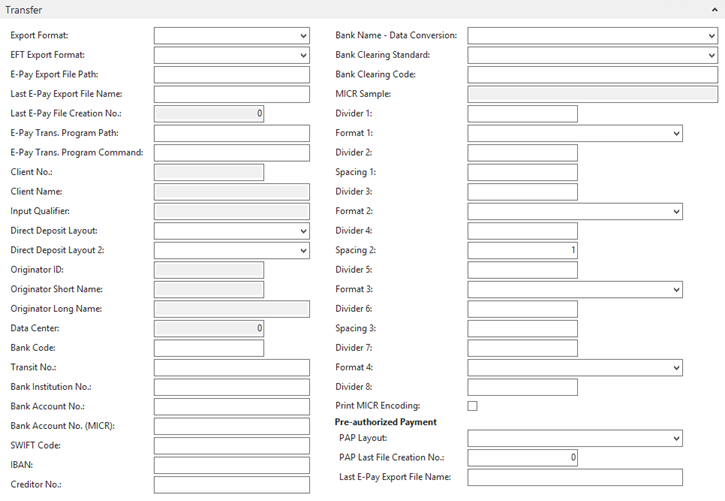

Transfer FastTab

The Transfer FastTab contains the following fields needed to make transfers to and from the bank account:

| Field | Description |

| Export Format | Select the country-specifc format that your bank uses. |

| EFT Export Format | Select the appropriate bank and format from the pre-defined list. |

| E-Pay Export File Path | Specify the full path of the secure network folder that will contain the EFT file from where it will be transmitted to the bank |

| Last E-Pay Export File Name | Enter the starting file name with no path. This file name should have digits in it, since the system will attempt to increment it every time it is used and should have the extension ".txt" |

| Last E-Pay File Creation No. | Specifies the last E-Pay file creation number. This number represents the last direct deposit file that was created and transmitted to the bank. |

| E-Pay Trans. Program Path | Specify the full path of the secure network folder that will contain the EFT file after it has been transmitted to the bank. |

| E-Pay Trans. Program Command | This field is optional and can be left blank. |

| Client No. | Specify the client number as provided by the bank. |

| Client Name | Specify the client name as provided by the bank. |

| Input Qualifier | Specify the input qualifier as provided by the bank. |

| Direct Deposit Layout | Select the template used for transmission to the bank. |

| Direct Deposit Layout 2 | Select the template used for transmission to the bank for the Deferred Leave Plan in Workforce. |

| Originator ID | Specify the originator ID as provided by the bank. |

| Originator Short Name | Specify the originator shaort name as provided by the bank. |

| Originator Long Name | Specify the originator long name as provided by the bank, if it is required by the bank specification. |

| Data Center | Specify the originator long name as provided by the bank, if it is required by the bank specification. |

| Bank Code | The bank code. |

| Transit No. | Defaults from the Posting Fast Tab. |

| Bank Institution No. | Specify the Bank Branch No. |

| Bank Account No. | Defaults from the General Fast Tab. |

| Bank Account No. (MICR) | The Magnetic Ink Character Recognition code for your Bank account number. |

| SWIFT Code | The international bank identifier code assigned to the bank. SWIFT Codes are typically used in automatic payment transactions. |

| IBAN | The bank account's International Bank Account Number (IBAN). The program checks whether the IBAN entered has the correct format and length. |

| Creditor No. | The Vendor identification number. |

| Bank Name - Data Conversion | Specify the data format of your bank to enable conversion of bank data by a service provider, if using such a service. |

| Bank Clearing Standard | Optional, this is an alternative to SWIFT and IBAN. |

| Bank Clearing Code | Optional, this is an alternative to SWIFT and IBAN |

| MICR Sample | A sample of the Magnetic Ink Character Recognition (MICR) account number. This field is read-only. |

| Divider # | Used for printing/sizing the MICR line at the bottom of a check. |

| Format # | Used for printing/sizing the MICR line at the bottom of a check. |

| Spacing # | Used for printing/sizing the MICR line at the bottom of a check. |

| Print MICR Encoding | Add a checkmark to this check box to include MICR encoding. |

| PAP Layout | Specifies the Pre-Authorized Payment layout. Choose the appropriate option from the drop-down list. |

| PAP Last File Creation No. | Specifies the last Pre-Authorized Payment number. |

| Last E-Pay Export File Name | Specifies the last e-pay export file name. |

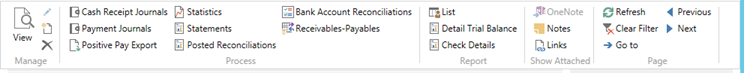

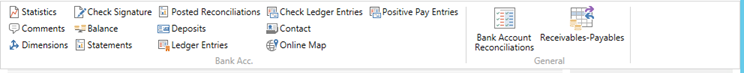

Bank Account Card Action Pane

The Bank Account Card includes the following options on Home and Navigation Ribbon:

| Option | Field |

| Cash Receipt Journal | Use to register and post payments from customers. |

| Payment Journals | Use to register and post payments to vendors. |

| Statistics | Displays the current balance for the account in the bank account currency and LCY and comparative figures from prior periods |

| Statements | Displays the reconciled Bank Account Statements for this bank account. |

| Bank Account Reconciliation | Displays the Bank Acc. Reconciliation List, which is described later. |

| List | Displays a list of all bank accounts in the system. |

| Detail Trial Balance | Displays options to print a detail trial balance for bank accounts. |

| Check Details | Displays options to print a detailed trial balance for selected checks. |

| Statistics | Same function as on the Action Pane. |

| Comments | Displays or enters any detailed comments that relates to this bank account. |

| Dimensions | Displays or enters default dimensions for this bank account. |

| Balance | Displays the Bank Account Balance page; it shows the balance or net change in the bank account in the bank account currency and LCY over time. |

| Statements | Same function as on the Action Pane. |

| Ledger Entries | Displays bank account ledger entries for this bank account. |

| Check Ledger Entries | Displays only the check ledger entries for this bank account. Use this option to financially void checks, as described in the Financially Voiding Checks. |

| Contact | Displays the company contact card for this bank account. When creating a new bank account, the system also creates and links a Company contact card to the bank account. |

| Online Map | Displays information about what map to display in the online map. The online map is set up in the Online Map Parameter Setup page. |

Creating a Bank Account

To create a bank account, follow these steps:

- In the Search field, type Bank Accounts and select the object from the drop-down list.

The Bank Accounts page displays. - Click New.

- In the No. field, enter a unique identifier for the bank account.

- In the Name field, enter the name of the bank.

- In the Address field, enter the address of the bank.

- In the Post Code field, click the drop-down list and select the bank account's postal code. The City field should be automatically populated.

- In the Country/Region Code field, click the drop-down list and select the country/region where the bank account is located.

- In the Phone No. field, enter the bank's telephone number.

- In the Contact field, enter the name of the contact person in the bank.

- In the Bank Branch No. field, enter the bank's branch number.

- In the Bank Account No. field, enter the bank account number.

- In the Our Contact Code field, click the drop-down list and select the person responsible in the company.

- On the Communication FastTab, complete the information in the fields.

- In the Currency Code field, click the drop-down list and select the bank account's currency.

- Complete the Last Check No., Last Statement No., and Balance Last Statement fields.

- In the Bank Account Posting Group field, click the drop-down list and select the appropriate posting group for this bank.

- Complete the Transit No., SWIFT Code, and IBAN fields.

- Click OK.