Pooled assets are assets that have multiple acquisitions after amortization has commenced and all the acquisitions in the pool have the same depreciation end date. A few examples of assets that should be dealt with in this way would be:

- Buildings with additions built after the initial construction, but the addition is considered as part of the initial asset and the desire is to depreciate the addition so that it is fully depreciated at the same time as the original asset.

- Leasehold improvements. These could well be pooled, as by definition the end date would all be the same for all acquisitions regardless of the acquisition date.

- Assets that are pooled by year of acquisition and do not have separate asset cards for each acquisition. Typically Furniture and Equipment and similar fixed assets would fall into this category.

At times, it is desired that the fixed asset system depreciates additions made to book value based on when the addition was made versus always using the asset’s Depreciation Starting Date. In a non-pooled asset, the system will “catch-up” the depreciation for any additions made after the start of depreciation using the asset’s Depreciation Starting Date.

By using pooling, the system considers all additions to book value for the acquisition month as a separate pool, to be depreciated from the first of that month to the Depreciation Ending Date. Alternatively, if Use Half-Year Convention is selected, the system will consider all additions to book value for the fiscal year as a single pool as if they were purchased at the mid-point of the fiscal year, to be depreciated from the fiscal year mid-point to the Depreciation Ending Date.

Pooled Assets and Entering Opening Balances

The Sparkrock solution does not support the loading of opening balances as acquisition and depreciation for previous pooled assets. If you would like them to be transferred, the current net book value needs to be entered as an acquisition and the asset depreciated from that point on. The remaining service life of the asset needs to be entered as years of depreciation for the newly created pooled asset.

Configuring Fixed Asset Pooling

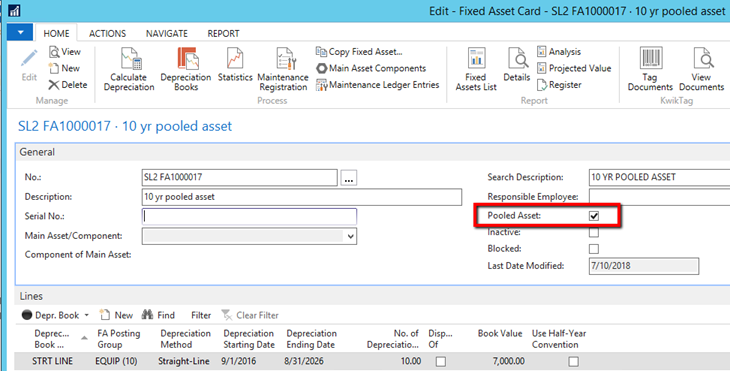

To indicate that a new fixed asset is to be depreciated on a pooled basis:

- Open the asset's Fixed Asset card.

- Add a checkmark to the Pooled Asset check box.

Notes:

- The Pooled Asset field cannot be selected (or de-selected) once depreciation entries have been posted to the asset.

- The Pooled Asset field can be defaulted in from the selection of a FA Subclass Code, using the field Pooled in the related lookup table.

- Asset Pooling works for both integrated and non-integrated depreciation books.

Fixed Asset Pooling Example

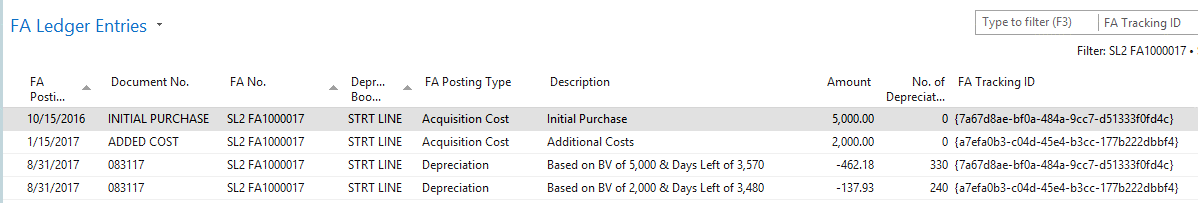

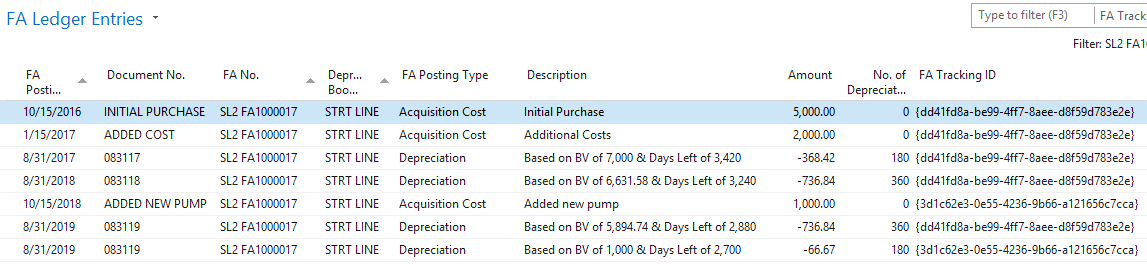

The following is an example of a pooled asset where two acquisition entries were posted in the fiscal year in different months and depreciation was run for the entire fiscal year:

By default, the system uses 30-day months (360-day fiscal years) to make sure each month / year receives a consistent amount of depreciation. In this example, the asset is not set to Use Half-Year Convention. Also, the fiscal year ends at 8/31.

The 10/15/16 acquisition is considered to be made at 10/1/16, which is one month after the start of the fiscal year. Thus, the system depreciates the acquisition layer for 330 days of the fiscal year as follows:

- $5,000 x (330 / 3,570 days left until 8/31/26) = $462.18

- 3,570 days left makes sense for a 10-year asset (10 x 360) less 30 (1 x 30) days.

The 1/15/17 acquisition is considered to be made at 1/1/17, which is four months after the start of the fiscal year. Thus, the system depreciates the acquisition layer for 240 days of the fiscal year as follows:

- $2,000 x (240 / 3,480 days left until 8/31/26) = $137.93

- 3,480 days left makes sense for a 10-year asset (10 x 360) less 120 (4 x 30) days.

Notes:

- Use the Description and No. of Depreciation Days to better understand how the depreciation was computed.

- The FA Tracking ID field is used to connect the depreciation entries back to the acquisition pools they relate to. The system uses a GUID value to make the connection since GUIDs are always unique. By filtering on one FA Tracking ID, you can easily view one pool, if desired.

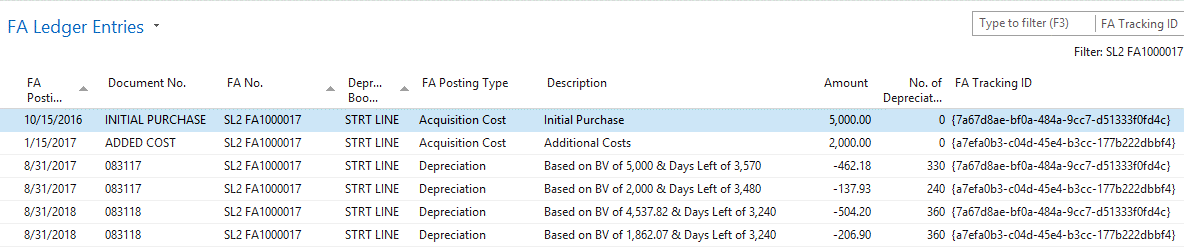

If the same asset is depreciated for the next fiscal year, the system calculates the depreciation as follows:

Notice how the formula uses the adjusted book value. An example for the $5,000 layer is:

- $5,000 - $462.18 (previous depreciation) x (360 / 3,240 days left until 8/31/26) = $504.20

If the same asset (with the same acquisitions) is set to Use Half-Year Convention, the first two fiscal years would look like:

In this case, the system considers both acquisitions as one pool. This is caused by the fact that with Half-Year Convention, the system considered both purchases to be made at the mid-point of the fiscal year (in this case as of 3/1/17). The system then depreciated the pool for 180 days (1/2 of the fiscal year). The days left is computed as 3,600 – 180. The next year follows the same pattern as described above.

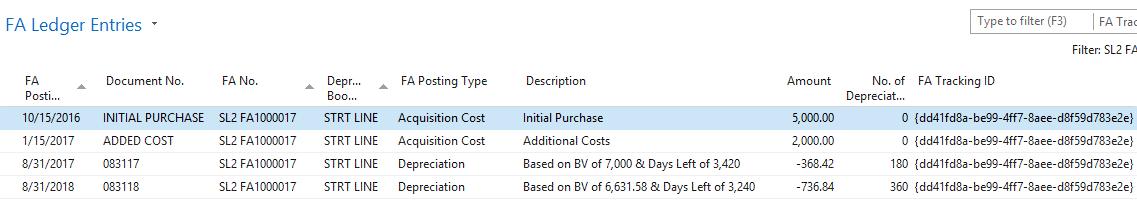

Now, let’s add some more acquisition costs in fiscal year 2019 (in Oct. of 2018) and depreciate the asset for 2019:

Notice that the system creates a new pool since the additional costs occurred in the next fiscal year. Also, note that the new acquisition is depreciated for a half-year even though the asset has already been depreciated in previous fiscal years.

Notes:

- Once a pool starts to be depreciated and acquisition costs are added to the same period, the system will recognize that a new pool needs to be created so that the additional costs are depreciated correctly.

- Appreciation and Write-Down entries are prorated to all pools based on current book value.