Understanding Accounting Periods

Before any posting can be done in a fiscal year in Microsoft Dynamics NAV 2016:

- Accounting periods must be defined.

- The fiscal year must be opened.

The shortest possible accounting period is one day and at least one accounting period must be set up for each fiscal year.

The Accounting Periods page is used to:

- Open new fiscal years

- Define accounting periods

- Close fiscal years

Accounting periods can be used as a time reference in Microsoft Dynamics NAV 2016. For example, when you are reviewing posted entries in a Balance/Budget window, the length of the accounting period, such as one month or one quarter, is specified.

Accounting Periods can be created by using one of the following methods:

- Manually

- Automatically, by using the Create Fiscal Year batch job.

Manually Configuring Accounting Periods

To set up accounting periods manually:

- In the Search field, type Accounting Periods and then select the page from the list. You can also navigate to Departments > Financial Management > Periodic Activities > Fiscal Year > Accounting Periods.

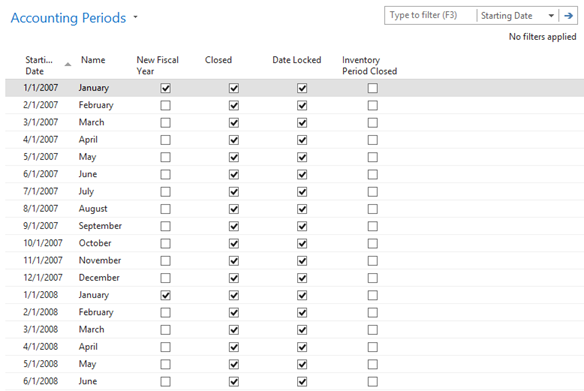

The Accounting Periods page displays.

- Click New.

- In the Starting Date field, enter the date that the accounting period begins.

- In the Name field, the system automatically updates the name of the month that corresponds to the Starting Date.

- Select the New Fiscal Year check box to indicate the start of the year.

- Repeat steps 4-5 for each month in the period.

The New Fiscal Year check box must contain a check mark if an accounting period is the first one in a fiscal year. Microsoft Dynamics NAV 2016 uses that period to determine which periods to close when the Close Year function is run.

Automatic Accounting Period Set Up

To run the Create Fiscal Year batch job:

- In the Search field, type Accounting Periods and then select the page from the drop-down list. Or, navigate to: Departments > Financial Management > Periodic Activities > Fiscal Year > Accounting Periods.

The Accounting Periods page displays. - From the Ribbon's Action tab, click Create Year.

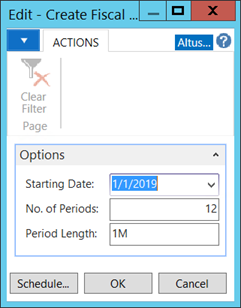

The Create Fiscal Year dialog displays.

- In the Starting Date field, enter the date on which the fiscal year starts.

- In the No. of Periods field, enter the number of accounting periods the fiscal year will be divided into. There can be from 1 to 365 periods.

- In the Period Length field, enter how long each accounting period will be, for example, 1M = 1 month, 1Q = 1 quarter, etc.

- Click OK.