Fixed asset depreciation is an important month-end procedure that recognizes the allocation of asset costs over its useful life. You can run depreciation against a depreciation book so that all fixed assets belonging to the depreciation book can be calculated by the system.

To perform fixed asset depreciation:

- Open Microsoft Dynamics NAV 2016.

- In the Search field, type Calculate Depreciation.

- Select Calculate Depreciation.

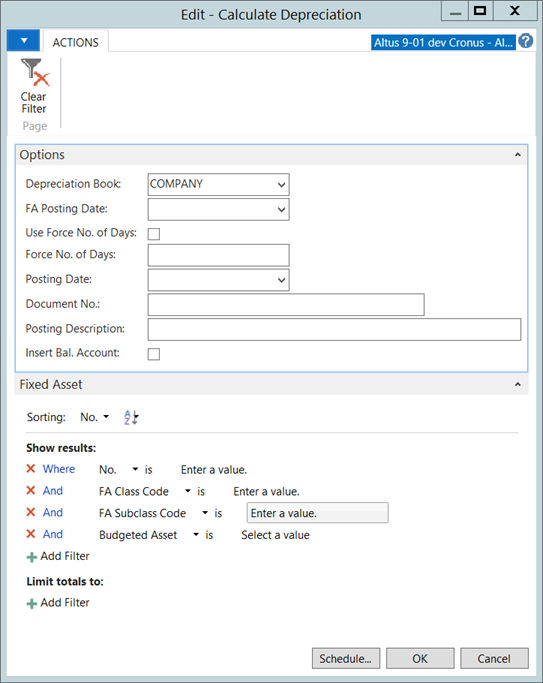

The Calculate Depreciation window displays.

- In the Depreciation Book field, choose Company.

- In the FA Posting Date field, select the date (typically the last day of the month).

- Leave the Use Force No. of Days check box unchecked.

- In the Posting Date field, use the drop-down list to select a posting date.

- Type a document number in the Document No. field.

- Type a description in the Posting Description field.

- Add a checkmark to the Insert Bal. Account check box.

- Optionally, use the Fixed Asset FastTab, to depreciate a specific group only.

- Click OK.

The system calculates depreciation journal entries in the Fixed Assed G/L Journal. - In the Search field, type and select FA G/L Journals.

- Review the depreciation journals and click either Post or Post and Print.

- Click OK.

- In the Search field, type and select G/L Registers.

- Scroll to the last entry (or press the Ctrl and End keys).

- From the Ribbon, click General Ledger.

- Verify the G/L journals and then close.