Implementation Method

The Sparkrock Asset Management module for Microsoft Dynamics NAV can be implemented using either an integrated or a standalone model.

- Integrated model - the financial and purchasing modules within Dynamics EDU and Microsoft Dynamics NAV are also being used;

- Standalone model - the financial, purchasing and accounts payable functions are being managed in another application. The intention is to maintain a very simple Chart of Accounts in the NAV G/L which includes only accounts related to asset transactions. Any data that is to be extracted for integration purposes to another General Ledger will be pulled from the NAV G/L.

Capital Assets

Capital Assets are non-financial assets with physical substance that:

- are held for use in the production or supply of goods and services, for rental to others, for administrative purposes or for the development, construction, maintenance or repair of other tangible capital assets;

- have useful economic lives extending beyond an accounting period;

- are to be used on a continuing basis; and

- are not for sale in the ordinary course of operations

In this document Capital Assets and Fixed Assets are terms that are used interchangeably.

Pooled Assets

A pooled asset is where a single asset record represents multiple “assets” or transactions flowing through it, and non-pooled assets where a unique asset equals an asset record. Each asset can only have one depreciation start date and therefore typically a pooled asset would be set up for each fiscal year and asset group.

Once a capital asset has been added to a pooled tangible capital asset class, it generally remains in the asset class until it is fully depreciated. This approach is justified when capital assets are typically utilized until the end of its useful life and when there is no significant advantage of reporting the assets on an individual basis, for example, when the balance of the tangible capital asset class would not be materially different if they were reported individually.

Capital assets recorded under the pooled cost approach are to be reported by year of purchase in the applicable capital asset class.

Capital assets recorded using the pooled cost approach have a deemed disposal at the end of their useful life; individual disposals are not generally recorded. If an asset is sold or disposed of before the asset has reached the end of its useful life, the proceeds (if any) are to be recorded as revenue.

Construction in Progress (CIP)

Construction in Progress assets refer to new capital asset construction projects that are not completed and not ready to be put into service. New building construction, the addition of a parking to an existing building and similar expenditures would qualify as construction in progress. Betterments made to an existing building are not construction in progress assets.

Construction in progress projects are not amortized until construction is completed and the asset is ready to be put into service.

Interest expenses related to financing costs incurred during the time the asset is under construction will be capitalized as part of the construction costs.

Assets under construction are to be transferred out to an appropriate tangible asset class when the construction is substantially complete and the asset is ready for use.

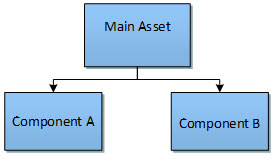

Asset Structure

Assets can be created as sub-assets (components) of main assets. The link between the main assets and the components allows summarized reporting and grouping by main asset. This structure can be used to combine multiple assets that represent projects of betterments to a building (components) with the building asset itself (main asset). The main asset and each of the components can have its own depreciation start date and depreciation period.

Locations / Sub Locations

A location record is typically set up for each physical location address such as the main office and each individual location. Sub Location records can be set up to track locations, areas, buildings, departments or wings within a location. These values are not passed through to the G/L but are used to track the physical location of an Asset.

Capital Asset Class / Capital Asset Subclass

Asset Class and Asset Subclass are categorizations of assets. In implementations of the Sparkrock Asset Management module the Asset Subclass is a sub grouping of the Asset Class. Many of the reports can be generated with subtotals for either level.

Depreciation Book

A depreciation book is a setup component within Microsoft Dynamics NAV that defines parameters related to asset transactions. The number of the depreciation books being created depends on the number of depreciation calculations that need to be tracked by an asset. This functionality allows the asset to be depreciated in more than one way at the same time such as computing depreciation for accounting purposes according to one schedule and computing depreciation for tax purposes according to another schedule. Typically, only one of these books is integrated to the G/L (Financials).

FA Depreciation Book

Each combination of a fixed asset number and a depreciation book code is called an FA depreciation book.

Contra Accounts

A contra account is an account that offsets the balance booked to another account. The purpose of the contra account in the Sparkrock Asset Management solution is to allow asset purchase transactions to be booked on an expense account at the same time as the asset account enabling the system to provide budget control. The expense account is offset against the accounts payable account, the balance sheet asset account is offset against the contra account.

Depreciation

For the purpose of this document Depreciation and Amortization are used interchangeably. Depreciation is the gradual conversion of the cost of a capital asset into an operating expense. The annual depreciation amount is calculated as the cost of the asset less its estimated residual value over the estimated useful life of the capital asset.

Tangible Capital Assets Setup Checklist

| Information | Page | Comments |

| Accounting |

FA Posting Group Journal Templates Reclass Journal Templates |

Set up FA posting and allocation key. Set up journal templates. |

| Basic Depreciation Set Up | Depreciation Book FA Journal Setup |

Defines various depreciation rules, integration with the general ledger and information that allows duplication of entries in several depreciation books. Define a default journal setup for each depreciation book. |

| Basic General Information | Fixed Asset Setup FA Classes FA Subclasses FA Locations and Sub-locations |

Set up number prefixes and default asset depreciation book. Create values for asset classes, subclasses, locations, and sub-locations. |

| Capital Assets | Fixed Assets | Define different reporting metrics and classifications specify the method of depreciation for each capital asset. |

| Employee Portal | Expense Type Categories Expense Types |

Define the setup necessary to acquire capital tangible assets as part of the standard purchase process. |