Using Fixed Asset Cards

For each capital asset, you can set up a card containing information about the asset that you can use to group your fixed assets into main assets and their components. For example, you may have a building that consists of many parts which you want to group in this way. Both the main asset and all its components must be set up as individual fixed asset cards. After you have set up a component list, the Main Assets/Components and Components of Main Asset fields on the fixed asset are automatically populated.

For further details on asset structure, please refer to the Asset Management Terminology section of this document

- Asset under Construction - Construction in progress assets are created as components of a main asset. After the construction is completed they are reclassified to a main asset or to another component that is of type asset.

- Pooled Assets - Capital assets recorded under the pooled cost approach are to be reported by year of purchase in the applicable capital asset class, thus you should be creating a pooled asset for each fiscal year and asset class. The Depreciation Starting Date for such asset should equal to the fiscal year start date.

- Posting by Main Asset - On the Fixed Asset Setup page (Fixed Assets Setup > FA Setup), you can allow posting to a main asset by placing a check mark in the Allow Posting to Main Asset check box. A main asset cannot be deleted until you remove its components from the component list.

The capital asset card is divided into separate tabs to categorize various types of information.

Creating Capital Assets

To create a capital asset:

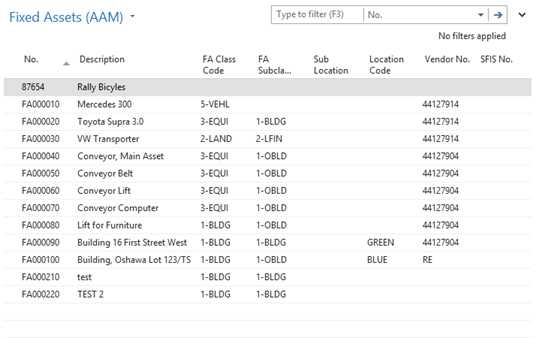

- Navigate to Asset Management > Fixed Assets (AAM).

The Fixed Assets list displays.

- From the Home Ribbon, click New to create a capital asset.

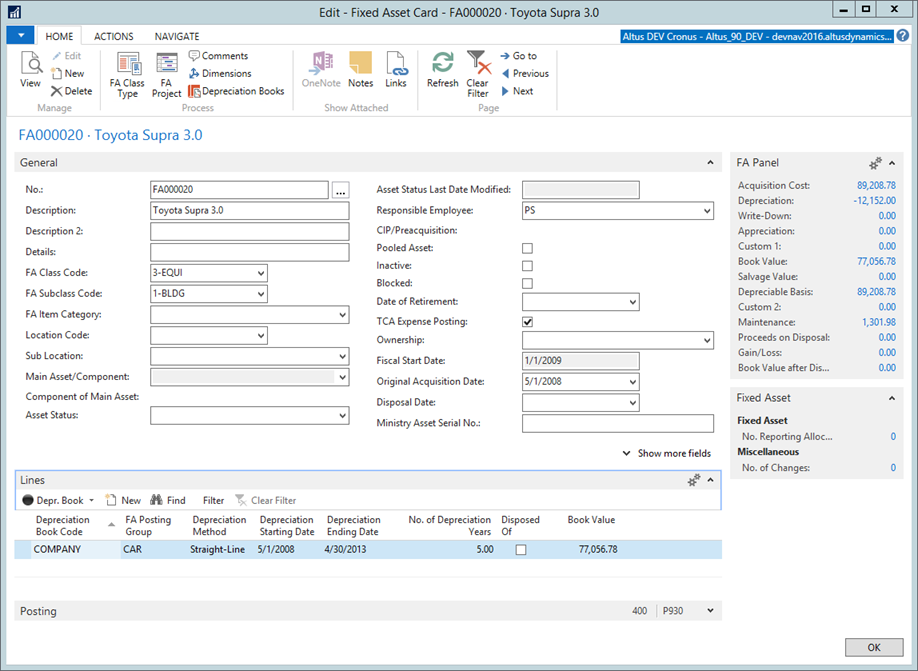

The New Fixed Asset card displays.

- Complete the following fields in the General FastTab:

- Leave the No. field blank (the number is automatically populated).

- In the Description field, enter a brief description for the asset.

- In the FA Class Code field, use the drop-down list to select the appropriate Class Code.

- In the FA Subclass Code field, use the drop-down list to select the appropriate Subclass Code.

Note: The CIP/Preacquisition field is filled in automatically by the FA Subclass (if the subclass is related to construction in progress). - In the Location Code field, use the drop-down list to select a location for the capital asset.

- Add a checkmark to the TCA expense posting checkbox if you are using Employee Center or if the asset is under construction.

- Enter a value in Original Acquisition Date field.

- Enter a value in Ministry Asset Serial No. field.

- Expand the Lines FastTab and complete the following:

- In the Depreciation Book Code field, select a depreciation book from the drop-down list.

- In the FA Posting Group field, select a Posting Group that will define the G/L accounts to be used for posting transactions to this asset and this depreciation book.

- In the Depreciation Starting Date field, enter the appropriate date.

- In the Depreciation Ending Date field, enter the appropriate date.

- Add a checkmark to the Use Half-Year Convention checkbox, if applicable.

- Repeat this step if the asset needs to be assigned to more than one depreciation book.

- Click OK.

TCA Expense Posting

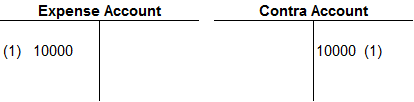

TCA Expense Posting field should be checked for all construction in progress assets or for all assets if Altus Employee Portal is used. The purpose is to create specific G/L Entries at the time of purchase transaction and to facilitate the purchasing process. The entries affect two Income Statement accounts as shown below:

The expense accounts hold the assets purchases and are compared against budgets. The use of the contra account will allow for proper financial statement reporting by netting out the asset purchases from the GL expense account originally used.

About Depreciation Methods

The Capital Assets application area contains the following rate-able and accelerated depreciation methods:

- Straight-Line (SL)

- Declining-Balance 1 (DB1), (SL principle used for depreciation during the course of the year)

- Declining-Balance 2 (DB2), (DB principle used for depreciation during the course of the year)

- DB1/SL (The greatest amount of DB1 and SL is used)

- DB2/SL (The greatest amount of DB2 and SL is used)

- Manual (No depreciation is being calculated)

- Straight-Line

Using the Straight Line 2 Depreciation Method

Straight-Line 2 is a custom depreciation method. Companies may choose to apply amortization to the nearest full month rather than applying it using the half-year rule. This method cannot be used in conjunction with the half year rule.

Depreciation = Depreciation 1 + Depreciation 2 – Depreciation 3

- Depreciation 1 calculates the current year year-to-date depreciation for transactions that took place in previous fiscal years. The base for this depreciation is the Net Book Value at the beginning of the fiscal year.

Depreciation 1= (Book Value−Salvage Value)/Remaining Service Life X No of months/12

- No of Months – the number of months between the Depreciation Date and the Fiscal Year Start Date

- Remaining Service Life – at the beginning of the fiscal year

- Depreciation 2 calculates the current year year-to-date depreciation for acquisition and additions that took place in the current fiscal year.

Depreciation 2 = (Value-Salvage Value)/(Remaining Service Life) X (No of actual months/12) X (No of months/No of actual months)

- No of Months – the number of months between the Depreciation Date and the Depreciation Start Date

- No of Actual Months - the number of months between the Fiscal Year End Date and the Depreciation Start Date

- Depreciation Start Date – if the acquisition transaction is before the Asset Depreciation Start Date the asset Depreciation Start Date is used. Otherwise, if the day is <=15 the Depreciation Start Date is the beginning of the current month, if the day is > 15 the beginning of the next month

- Remaining Service Life – at the beginning of the fiscal year or estimated service life in the year of acquisition

- Salvage Value – not applicable for pooled assets

- Depreciation 3 is the posted accumulated depreciation year-to-date.

Depreciation 3=Accumulated Depreciation YTD

- Custom 1 and Custom 2 if used as FA Posting Type are always part of the depreciation calculation. Their behavior is controlled through the Depreciation Type checkbox from the FA Posting Type Setup. If Depreciation Type is checked the amounts posted are included in Depreciation 3 calculation above. If not checked, the amounts posted are treated as Appreciation and are included in Depreciation 2 calculation.

Following the Half Year Rule

At a minimum, the Half Year rule should be applied to all new tangible capital assets acquired in a given fiscal year. Under the half year rule, six months of amortization is recorded for tangible capital assets acquired during a fiscal year. Therefore a five year asset will actually be fully amortized over six years as follows:

- Year 1 - ½ year

- Year 2 - full year

- Year 3 - full year

- Year 4 - full year

- Year 5 - full year

- Year 6 - ½ year (remaining from year 1)

Depreciation Ending Date

Depreciation Ending should always be month end date. You can calculate the depreciation end date for existing assets using the formula below:

End of Month (Depreciation Ending Date) = Last Depreciation Date + Remaining Service Live (in years) * 365

Remaining Service Life

Remaining Service Life (RSL) of an asset is calculated based on 360 days. The Excel equivalent of the formula that has been used is Days360.

Periodic Depreciation

The program can calculate daily depreciation thus allowing you to calculate depreciation for any period. You can therefore analyze current operating results on, for example, a monthly, quarterly, or annual basis. The program uses a standard year of 360 days and a standard month of 30 days in the calculation. If a capital asset is used by several departments, periodic depreciation can be automatically allocated to these departments according to a user-defined allocation table.

Entering Comments about a Capital Asset

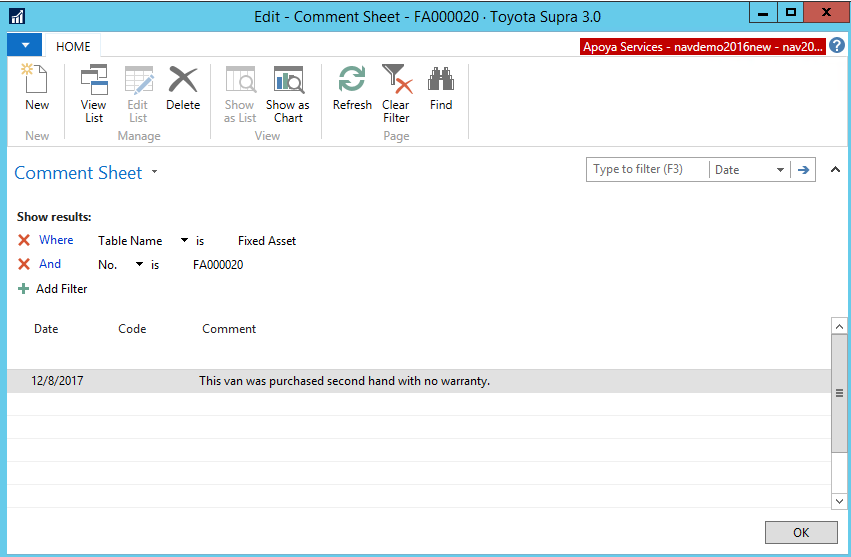

To enter a comment about a fixed asset on the fixed asset card, follow this procedure:

- Open the Fixed Asset Card.

- In the Ribbon, click Comments.

The Comments page displays.

- Fill in as many lines as necessary. You can fill in a date for each comment. In the Comment field on each line, you can enter a maximum of 80 characters (including spaces).

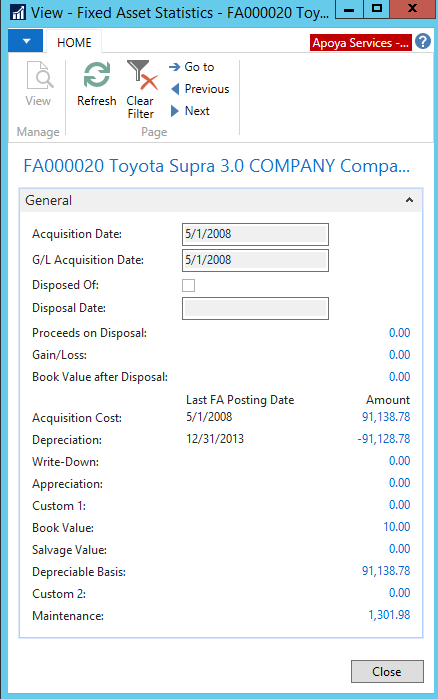

Viewing Statistics for a Depreciation Book

For each capital asset depreciation book, there is a Statistics page that provides a quick overview of the book value, depreciable basis, accumulated depreciation, and gains or losses on sales. Each main asset has its own statistics page.

To view the statistics for a depreciation book:

- Open the Fixed Asset Card page.

- From the Ribbon, click the Navigate tab and then click Fixed Asset Statistics.

The Statistics page opens.

Modifying and Deleting Fixed Asset Cards

You may need to add, change, or delete fixed assets. This section explains how these changes can be made.

Modifying a Fixed Asset

All modifications are made on the fixed asset cards.

To modify a fixed asset:

- Click Asset Management> Fixed Asset Card.

The Fixed Asset card displays. - Make the following changes as necessary:

- Changing a Fixed Asset Number: You can change the number of a fixed asset by entering a new number in the No. field and confirming a message from the program. The change can take time because the program must check all the windows in which the fixed asset number appears and replace the number on all the relevant entries.

- Changing Comments: If you have entered a comment on a fixed asset card, you can change or delete the text. Click Fixed Assets > Comments on the Fixed Asset Card and make the necessary changes in the Comment Sheet page.

- Changing Other Information: In all other data entry fields, you can change the information as needed.

- Deleting Fixed Assets: To delete a fixed asset card, go to Fixed Assets list, right-click mouse, and select Delete (or hit Ctrl+Delete button)