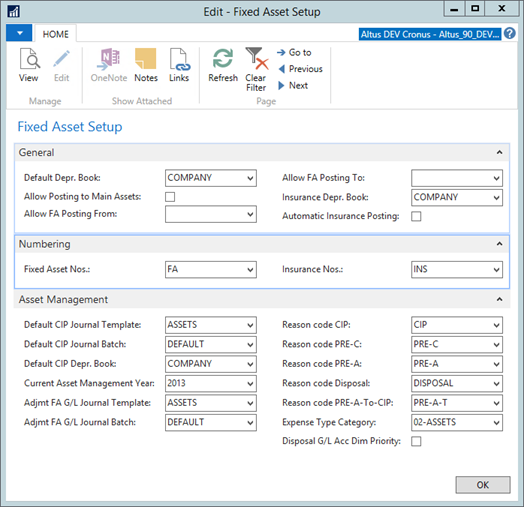

Completing the Fixed Asset Setup Page

The Fixed Asset Setup page is used to define the default depreciation book to use for asset transactions (General FastTab) and the number prefixes for asset and insurance numbers (Numbering FastTab). The Asset Management FastTab is used in relation to construction in progress tangible capital assets.

To complete fixed asset set up:

- Navigate to Departments > Financial Management > Fixed Assets> Setup> FA Setup.

The Fixed Asset Setup page displays.

- Fill in the fields according to these guidelines:

- Default Depr. Book: set the default depreciation options for new capital assets.

- Allow Posting to Main Assets: if you have assets with sub-components, click to insert a check mark to be able to add them to the main assets. If all additions are to be handled as additional sub-components do not check the box.

- Allow FA Posting From / To: establish the start and finish dates for the Fixed Asset module (optional).

- Insurance Depr. Book: select the depreciation book that you want to use.

- Automatic Insurance Posting: Add a checkmark if you want to post insurance coverage ledger entries automatically when you post acquisition cost entries.

- Expand the Numbering FastTab and fill in the fields according to these guidelines:

- Fixed Asset Nos.: enter the prefix you would like for fixed assets, for example FA.

- Insurance Nos.: enter the prefix you would like for insurance, for example INS.

- Expand the Asset Management FastTab and fill in the fields according to these guidelines:

- Default CIP Journal Template: select the default Journal Template from the drop-down list.

- Default CIP Journal Batch: select the default Journal Batch from the drop-down list.

- Default CIP Depr. Book: select the default Depreciation Book from the drop-down list.

- Current Asset Management Year: select the current asset management year from the drop-down list.

- Adjmt FA G/L Journal Template: select the default Adjustment Journal Template from the drop-down list.

- Adjmt FA G/L Journal Batch: select the default Adjustment Journal Batch from the drop-down list.

Note: See the next section for details on assigning reason codes to the respective CIP transaction.

- Click OK when finished.

Assigning Reason Codes to Assets

Reason codes are used for tracking the conversion of construction in progress assets to assets of another stage. The reason code defines the initial stage before the change.

| Reason Code | From | To |

| CIP | CIP | Asset |

| PRE-C | Pre-construction | CIP |

| PRE-A | Pre-acquisition | CIP |

| Disposal | Any CIP status | Disposed Of |

| PRE-A-T | Pre-acquisition | Asset |

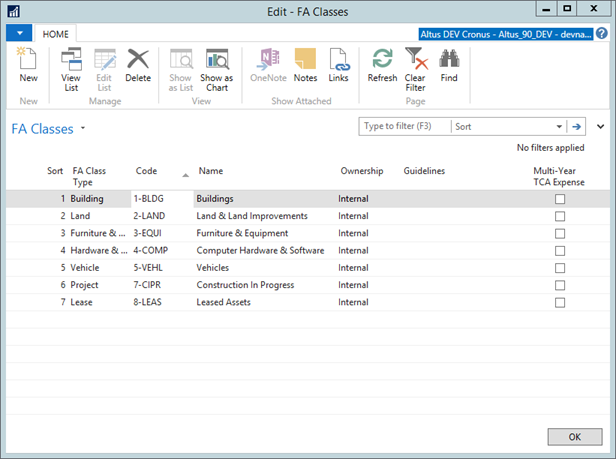

Creating your Fixed Assets List

Asset Class is a reporting metric that is used for grouping your capital assets.

The following list provides a sample of the most commonly used capital asset classes:

- Buildings

- Land & Land Improvements

- First Time Equipping

- Furniture & Equipment

- Computer Hardware & Software

- Vehicles

To create the list of asset classes:

- Navigate to Departments > Financial Management > Fixed Assets> Setup> FA Classes.

The FA Classes page displays.

- To create a record, from the Ribbon, click New.

- In the following columns, enter values for:

- FA Class Type

- Code

- Name

- Ownership

The following are samples of FA Classes for Sparkrock Asset Management implementations:

| Code | Name | Ownership |

| 1-BLDG | Buildings | Internal |

| 2-LAND | Land & Land Improvements | Internal |

| 3-EQUI | Furniture & Equipment | Internal |

| 4-COMP | Computer Hardware & Software | Internal |

| 5-VEHL | Vehicles | Internal |

| 6-RMVD | Assets Removed (do not use) | Internal |

| 7-CIPR | Construction in Progress | Internal |

| 8-LEAS | Leased Assets | Internal |

Understanding Field Characteristics

Field characteristics are as follows:

- Code – 10 alphanumeric characters

- Name – 50 alphanumeric characters

- Ownership – Option – Internal/External

- Guidelines – 250 alphanumeric characters – use for tracking general guidelines for the user of this FA Class

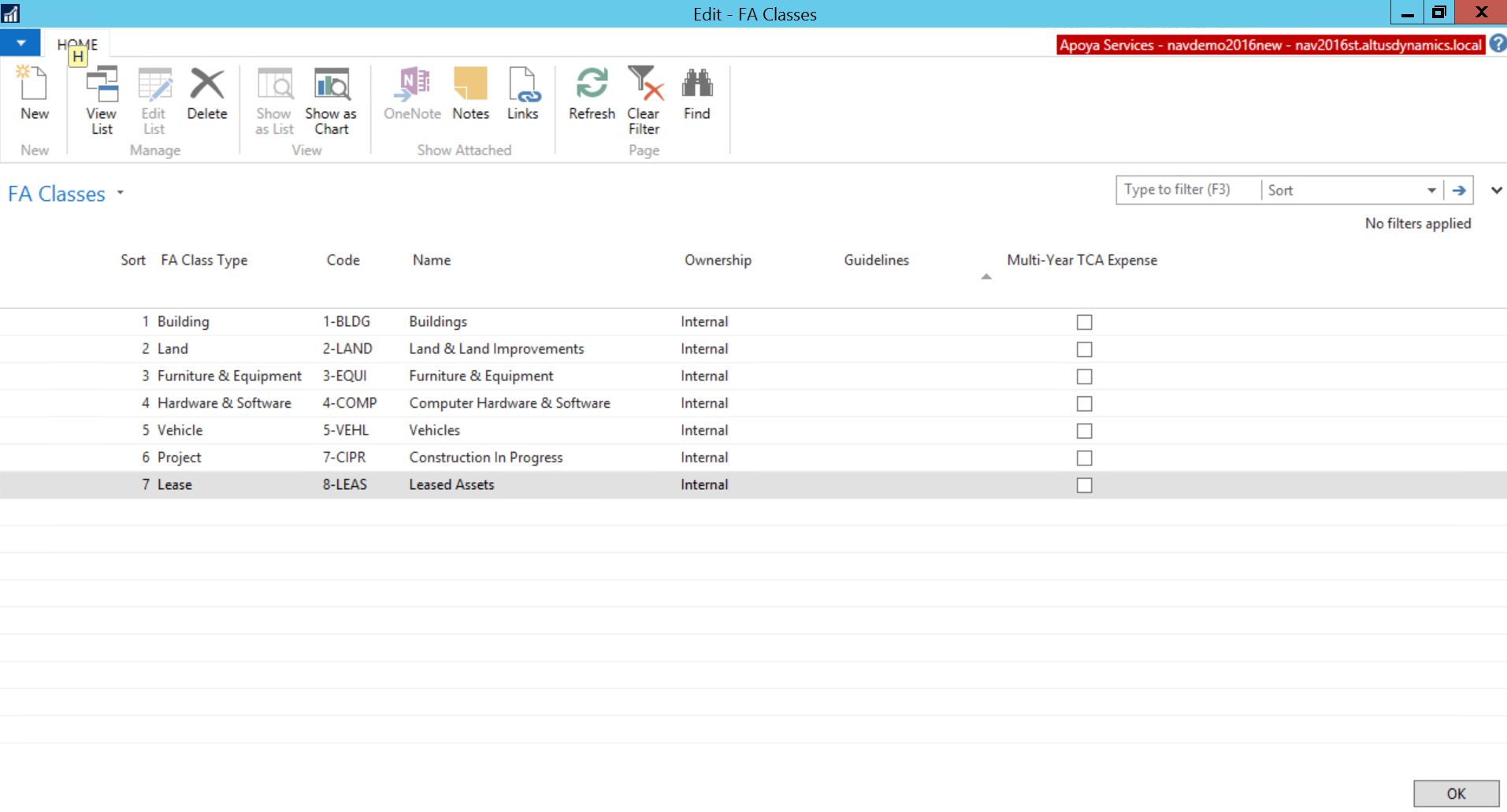

Using the Pre-defined FA Class Types

FA Class Type is a pre-defined list that contains the following values:

- Land

- Building

- Furniture & Equipment

- Hardware & Software

- Vehicle

- General

- Project

- Lease

When setting up your FA Class Types use the following as an example/model:

When linked to an Asset Class the FA Class Type determines what detailed fields by asset are available in the FA Class Type FastTab in the Fixed Asset card.

For example, the Construction in Progress Asset Class should be linked to FA Class Type Project.

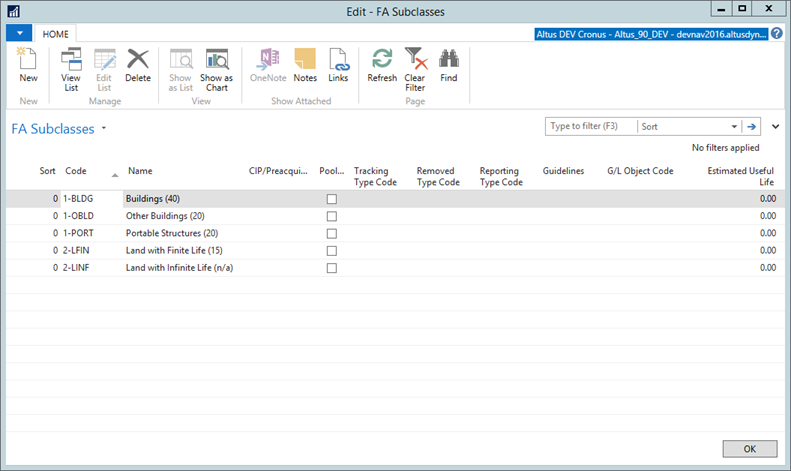

Creating Asset Subclass Lists

The Asset Subclass is used to further group assets within classes. For example:

- Buildings

- Buildings (40 years)

- Portable Structures – RCM, PO, PT (20 years)

- Other Buildings (20 years)

- Land & Land Improvements

- Land Infinite

- Land Finite

- First Time Equipping

- Furniture & Equipment

- Equipment – 5 years

- Equipment – 10 years

- Equipment – 15 years

- Furniture – 10 years

- Computer Hardware & Software

- Computer Hardware

- Computer Software

- Vehicles

- Vehicles < 10,000 pounds

- Vehicles >= 10,000 pounds

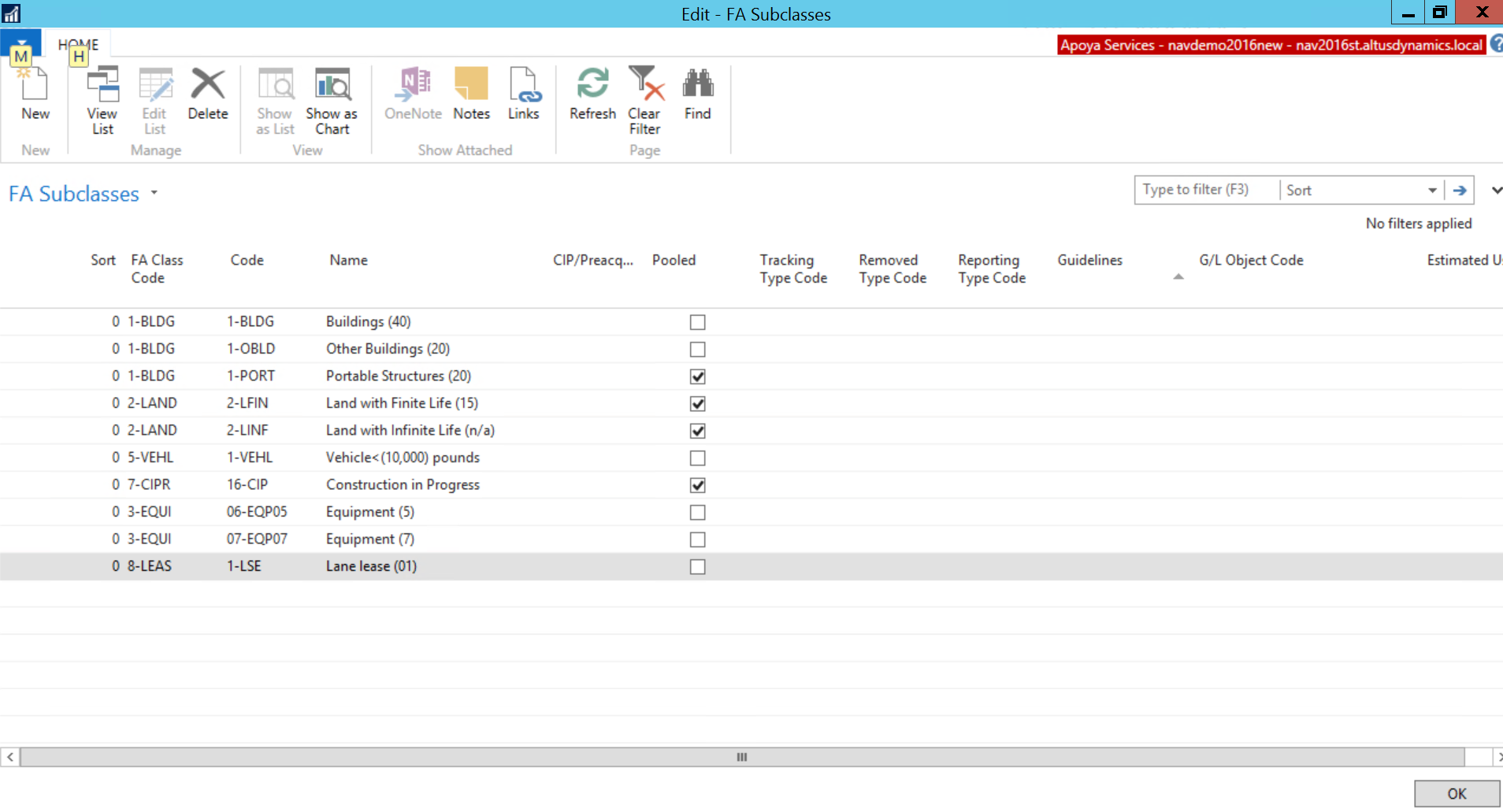

To create the list of asset classes:

- Navigate to Departments > Financial Management > Fixed Assets> Setup> FA Subclasses.

The FA Subclasses page opens.

- To create a new record, from the Ribbon click New.

- In the following columns, enter values for (see the next sections for assistance in entering the following values):

- FA Class Code

- Code

- Name

- CIP/Pre-acquisition for the construction in progress assets

- Check pooled if the assets belonging to that subclass are being pooled

- The following are samples of FA Subclasses for Sparkrock Asset Management implementations:

| FA Class Code | Code | Name | Pooled |

| 1-BLDG | 1-BLDG | Buildings (40) | No |

| 1-BLDG | 1-OBLD | Other Buildings (20) | No |

| 1-BLDG | 1-PORT | Portable Structures (20) | Yes |

| 2-LAND | 2-LFIN | Land with Finite Life (15) | No |

| 2-LAND | 2-LINF | Land with Infinite Life (n/a) | No |

| 3-EQUI | 3-EQP10 | Equipment (10) | Yes |

| 3-EQUI | 3-EQP15 | Equipment (15) | No |

| 3-EQUI | 3-EQP5 | Equipment (5) | Yes |

| 3-EQUI | 3-FTEQ | First Time Equipping (10) | Yes |

| 3-EQUI | 3-FURN | Furniture (10) | Yes |

| 4-COMP | 4-HRDW | Computer Hardware (5) | Yes |

| 4-COMP | 4-SFTW | Computer Software (5) | Yes |

| 5-VEHL | 5-G10K | Vehicles > 1 Ton (10) | No |

| 5-VEHL | 5-L10K | Vehicle < 1 Ton (5) | No |

| 7-CIPR | 7-CIPR | Construction in Progress (n/a) | No |

| 8-LEAS | 8-BLDG | Capital Lease Building (life) | No |

| 8-LEAS | 8-BLHI | Capital Lease Building Leasehold (term) | No |

| 8-LEAS | 8-LAND | Capital Lease Land (n/a) | No |

| 8-LEAS | 8-LLHI | Capital Lease Land Leasehold (term) | No |

| 8-LEAS | 8-OLHI | Capital Lease Other Leasehold (term) | No |

| 8-LEAS | 8-OTHR | Capital Lease Other (life) | No |

Field Characteristics

Field characteristics are as follows:

- FA Class Code – 10 alphanumeric characters – link to the FA Class Table

- Code – 10 alphanumeric characters

- Name – 50 alphanumeric characters

- Pooled – Boolean – Yes/No

- Guidelines – 250 alphanumeric characters – use for tracking general guidelines for the user of this FA Class

CIP/Pre-aquisition

CIP/Pre-acquisition is a pre-defined list that contains the following values:

- CIP

- Pre-acquisition (e.g. survey charges)

- Pre-Construction (e.g. building permits)

These values are assigned only to FA Class Code CIPR and used for reporting purposes to track the reclassification from one stage of the construction of progress to another.

Pooled Assets

A pooled asset is where a single asset record represents multiple assets or transactions flowing through it.

The following provides an example of FA Subclasses that are indicated as Pooled Assets.

For more information on pooled assets, please refer to the Asset Management Terminology section of this document.

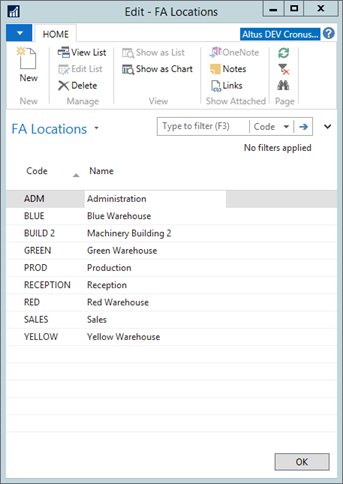

Registering the Location of a Capital Asset

The Location code is used to register the location of the capital asset, for example, sales department, reception, administration, production, or warehouse. This information is useful for insurance and inventory purposes.

To create the list of asset locations:

- Navigate to Departments > Financial Management > Fixed Assets> Setup> FA Locations.

The FA Locations page displays.

- To create a new FA location record, from the Ribbon click New.

A new Location card opens enabling you to set up a code and a description for all of your capital asset locations. - Click OK when completed.