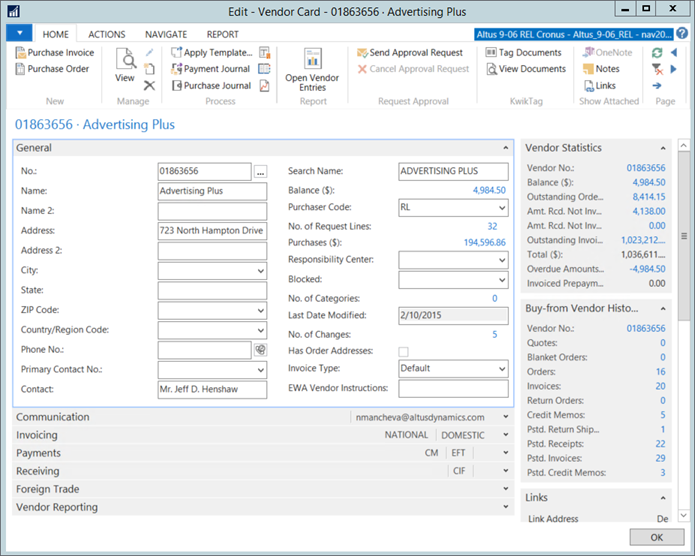

Vendor Card

To configure the Vendor Card:

- In the Search field, type Vendor.

- Select a vendor and double-click to open. Or, go to Departments > Financial Management > Payables > Lists > Vendors.

The Vendor Card displays.

There are several FastTabs on the Vendor Card:

| FastTab | Description |

| General | Vendor general contact and relevant details are entered and saved. |

| Communication | Vendor phone, fax, email, home page, and IC partner code. |

| Invoicing | Vendor specific invoice type setups are entered such as tax codes. Several of the fields on this card will cause a certain behavior of Vendor entries within the system. |

| Payments | Vendor specific payment and relevant information is entered such as payment terms. |

| Receiving | Vendor specific receiving information is entered, such as which location goods are received, lead times, and so on. |

| Foreign Trade | Vendor specific currency information such as whether this vendor is transacted within a different currency, what the vendor's check formats are, and so on. |

| Vendor Reporting | Vendor tax reporting information. |

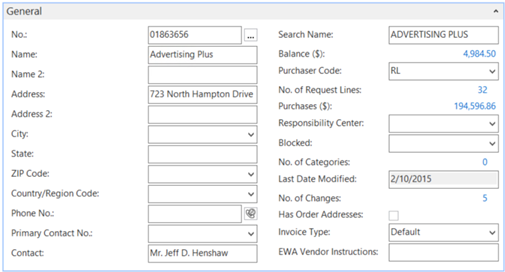

General FastTab

The following fields are on the General FastTab:

| FastTab | Description |

| No. | Vendor number in the NAV system. This can be either manually entered, or auto-numbered depending on the no. series. |

| Name, Address, Phone, etc. | This is the vendor's main contact and Buy-From info which is usually the Pay-To as well but can be different (see Invoicing FastTab). The Name is what is printed on the check. |

| Primary Contact No. | This is a drop-down list from the contact database in the Relationship Management area. A contact and address for the contact person at the vendor can be selected if a list exists. |

| Contact | If not using the contact from the Relationship Management area, enter a contact here. |

| Search Name | A search name to search for a vendor when you cannot remember the vendor number. Defaults from the vendor name, but can be edited. You can also use the Name 2 field as the secondary name field. |

| Balance | Flow field showing current AP balance based on the total in the vendor's ledger entries. |

| Purchaser Code | Purchaser (Buyer) assigned to this Vendor from a table of valid purchasers. |

| No. of Request Lines | Purchase Requests Line list. |

| Purchases ($) | Vender ledger entries. |

| Responsibility Center | Responsibility center will administer this vendor by default. Likely not used at all. |

| Blocked |

|

| No. of Categories | Displays the vendor categories. |

| Last Date Modified | Shows last date when the Vendor card was modified by a user. |

| No. of Changes | Change log entries for the current vendor card. |

| Has Order Addresses | Check if current vendor has other addresses or not. |

| Invoice Type | Specifies the invoice type This determines what defaults as the invoice posting description on Accounts Payable invoices. Options are:

|

| EWA Vendor Instructions | Specifies any instructions required for this vendor. |

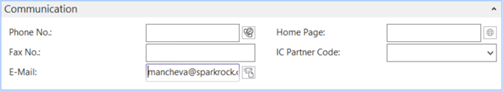

Communications FastTab

The following fields are on the Communications FastTab:

| FastTab | Description |

| Phone No. | Phone number of the vendor, normally accounts payable or sales person. |

| Fax No. | Fax number of the vendor. |

| Email address of the vendor. | |

| Home Page | Home page of the vendor. |

| IC Partner Code | Used for intercompany sales transactions if the vendor is another company within the group. |

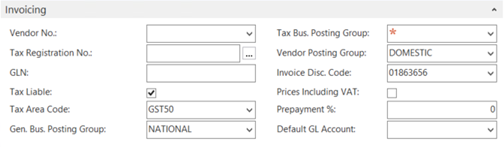

Invoicing FastTab

The following fields are on the Invoicing FastTab:

| FastTab | Description |

| Pay-to Vendor | If the vendor is paid different form the vendor that the order is placed with or does the delivery (i.e. Stables head-office bills for one of the branches), select that vendor's number or fill in here. The program will enter this vendor number on quotes, orders, invoices, and credit memos as a default which the user will be able to change. |

| Tax Liable | This box should be checked if sales taxes are to be charged to this vendor during purchase transactions. |

| Tax Area Code | Use the drop down to enter the proper tax table for this vendor. |

| General Business Posting Group | This determines which GL accounts the purchases will be posted to. Based on the type of vendor, select from list of valid choices, Note: This field is only used if the Inventory module is active. |

| Tax Bus. Posting Group | Only for VAT. |

| Vendor Posting Group | This determines which GL accounts for AP, interest, and so on are posted to. Based on the type of vendor, select from a list of valid choices. |

| Withholding Tax Code | Setup for foreign vendors if you are obliged to pay the vendor the invoice amount less the withholding taxes and remit the withholding taxes to CRA. |

| Prices Including VAT | Do not check - this can be used to price all goods including tax. |

| Prepayment % | If normally this vendor must be prepaid for orders, enter the % which becomes the default on all new POs for this vendor. |

| Default GL Account | This determines which GL account will be used for posting invoices from this vendor. |

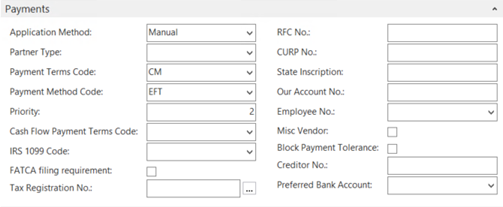

Payments FastTab

The following fields are on the Payments FastTab:

| FastTab | Description |

| Application Method | Select how to apply payments from vendors to outstanding amounts:

|

| Payment Term Code | Payment terms for this vendor for a list of valid payment terms. This is used to calculate the invoice due date |

| Payment Method Code | Method that the vendor usually uses to submit payment (For example, check or EFT). |

| Priority | The priority field can be used if only a limited amount is available for payments. In this case, assign a priority to each vendor:

|

| IRS 1099 Code | This field shows the code for the 1099 that the vendor entry is linked to. (US Only). |

| Tax Registration No. | Specifies the vendor's tax registration number. |

| RFC No. | Specifies the RFC (Registro Federal de Contribuyente) tax identification number for Mexican vendors. |

| CURP No. | Specifies the unique fiscal card identification number. (Mexico Only). |

| State Inscription | Specifies the tax ID number. (US Only). |

| Our Account No. | Account number on the vendor's system. |

| Employee No. | Specifies the employee number. Note: This field only applies if you are using the HR module. |

| Misc. Vendor | Enable this option for vendors that you may not have future transactions with. |

| Block Payment Tolerance | A check mark in this field indicates that the vendor is not allowed payment tolerance. |

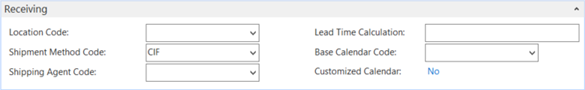

Receiving FastTab

The following fields are on the Receiving FastTab:

| FastTab | Description |

| Location Code | Default warehouse a vendor shipment is received into. |

| Shipping Method Code | The default method code (i.e. pickup, delivery, etc.). |

| Shipping Agent Code | This is the default agent of shipping to this vendor such as UPS, DHL, etc. |

| Lead Time Calculation | Enter the time it takes from when the order is placed to when the order is delivered to FSI (that is, 5D is 5 days, 1W is 1 week). The program uses the Lead Time field to calculate planned delivery date and the promised delivery date on the purchase order. |

| Base Calendar Code | Not used. |

| Customized Calendar | Not used. |

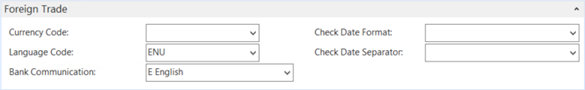

Foreign Trade FastTab

The following fields are on the Foreign Trade FastTab:

| FastTab | Description |

| Currency Code | Blank if the vendor is transacted in Canadian dollars. |

| Language Code | If the vendor has to be transacted on documents in their local or own language it can be selected here. |

| Bank Communication | Always English. |

| Check date format | The format to be used on the checks (for example, MM DD YYYY). This overrides the Bank Account card default. |

| Check Date Separator | Code to separate the date on a cheque (normally 'blank'), normally '-' -- Canadian Check Standards |

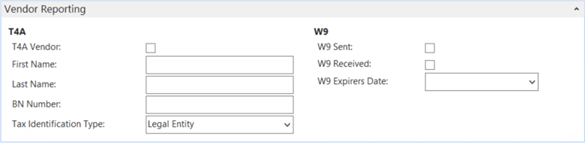

Vendor Reporting FastTab

| FastTab | Description |

| T4A Vendor | Enable this check box to include a T4A form for this vendor. |

| First Name | Vendor first name as it appears on the T4A form. |

| Last Name | Vendor last name as it appears on the T4A form. If the Tax ID Type is Legal Entity, then the company name goes in this field. |

| BN Number | Specifies the nine-digit business number assigned by Canada Revenue Agency. This field is only required if the vendor is a legal entity. |

| SIN Number | Social Insurance number. Fill out this field instead of BN Number when the Tax ID type is Natural Person. |

| Tax Identification Type | The tax identification type. Can be either:

|

| W9 Sent | Enable this check box to include a W9 form with payment. (US Only). |

| W9 Received | Enable this check box to indicate that a W9 form was received. (US Only). |

| W9 Expires Date | Specify the date on which the W9 form expires. (US Only) |